Range Accrual Swaps – A Dangerous Game

The relentless surge in interest rates was always going to trouble financially leveraged corporations and institutions exposed to floating rate debt. Yet it is now apparent the surge also severely impacted – and at times more significantly – a local group of derivative users.

In a webinar earlier this month, we discussed the so-called “Interest Rate Cheapeners.” This is an attractive but sometimes misleading description of a derivative product aiming to reduce (or “cheapen”) funding costs for companies that use debt in their daily operations. More than 10% of corporates and institutions who attended the webinar indicated that they currently have structured derivatives and cheapeners in their portfolio.

In this article, I discuss a specific species of interest rate cheapeners: Range Accrual Swaps (RAS).

Why Discuss Range Accrual Swaps? Why Now?

The floating interest rate index in the local market, represented by the Saudi Arabian Interbank Offered Rate (SAIBOR), recently smashed records and reached a new high in decades. The 3-Month SAIBOR topped 5.78% on Thursday, 27th October 2022, up from under 1.00% earlier this year!

Let us avoid entangling ourselves in the U.S. Federal Reserve’s battle against inflation and its hiking pace. We focus on how overconfidence led to unprecedented and massive derivative losses for many corporates who had become too comfortable with cheapener products over the last decade.

Some financial institutions sell these products to their clients. In almost all of them, the upside for the company is limited, but the downside is unlimited. What is the catch? How are these corporates enticed with such a risky payoff profile? The short answer: the upside, although limited, has a higher probability of materializing than the downside. Let us dig deeper into the product details.

Range Accrual Swaps Explained

RASs are straightforward. The company gets to enjoy a fixed subsidy (e.g., 0.50% or 1.00% of a fixed pre-set amount) over the agreed period (typically 3-5 years). This subsidy is contingent upon a clear condition.

One of the most widespread conditions for RASs is a specific SAIBOR range. If, for example, SAIBOR remains between 0.00% and 3.50% over the agreed period, the subsidy takes effect. However, when SAIBOR breaks the range, the company must pay the prevailing interest rate. Additionally, sellers of these products typically have a “callability” option granting them the right to cancel the product after a certain period.

Linking the example with the current interest rate environment, the 3-Month SAIBOR has broken the upper range of 3.50% and is currently at 5.78%. That means the company will suffer a massive floating interest rate payment (now 5.78% per annum) for every day the SAIBOR exceeds the range. This obligation “accrues”, with the firm paying periodically (its exposure to losses is therefore unlimited). The seller of this product will obviously avoid canceling the product while it works in its favor.

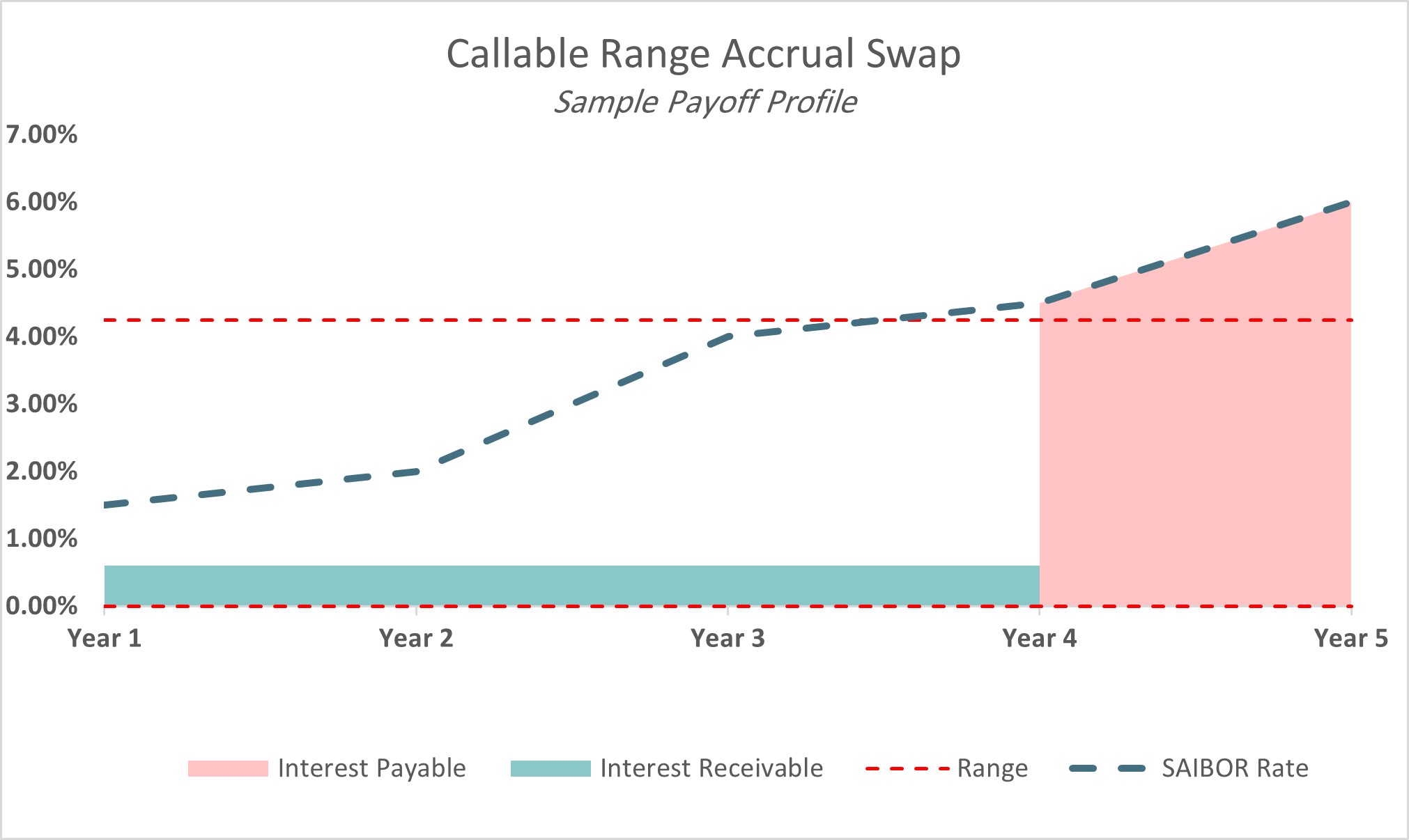

The graph below demonstrates an example of a typical RAS transaction mechanism with hypothetical levels. As the graph illustrates, the SAIBOR range is between 0.00% and 4.25%, with a subsidy of 0.50%. We can notice that breaching a range exposes the firm to unlimited losses. Given that SAIBOR levels maintained a narrow range for over a decade of expansionary monetary policy, what do these new developments mean now?

Looming Chaos

Suppose SAIBOR rates continue trending higher or remain elevated. Many firms risk the realization of significant negative cashflows and mark-to-market (MTM) values, exposing them not only to a liquidity squeeze but also critical accounting implications.

The extended period of low interest rates lured some firms into acting impulsively. They took progressively larger risks to generate revenue. Now, the ugly truth is that a single loss could easily erase multi-year savings and expose these firms to more substantial losses.

Worsening the situation, corporations who restructured their RASs are more likely to accept a riskier profile. Typically, the seller of the original product would offer to increase the transaction amount and/or extend the period. The aim is to widen the SAIBOR range. What happens if the SAIBOR breaks the new range? I leave this to your imagination!

What Now?

Stepping back, the purpose of interest rate cheapeners should be to offer a debt cost reduction while forgoing a “calculated and limited” upside. Yet firms looking to avoid the unlimited downside of a RAS might consider other strategies. For example, as an alternative, an interest rate collar could reduce the premium on purchasing an Interest Rate Cap (IRC) by simultaneously selling a lower-strike Interest Rate Floor (IRF). If rates increase, the IRC strike will protect the firm unlimitedly. And before all this, the companies must navigate the genuine rationale for hedging.

Financial institutions are obligated to understand their clients’ commercial requirements and must refrain from selling complex and speculative products just because clients ask them to do so. Products such as RASs aggravate the risk right when the firm most needs the hedge, exploiting such products’ speculative nature.

Firms must approach the restructuring of complex derivative trades cautiously and follow an effective interest rate hedge approach. The opaque and complicated pricing is conducive to asymmetric knowledge between the buyer and seller, endangering unwary firms. Risk quantification and demonstration, therefore, is a crucial step in dealing with an existing “derivative crisis.”