Initial Market Reactions to Uncertainty: A Comparative Look at Key Economic Events

In April 2025, the United States announced a series of tariff measures intended to recalibrate trade relationships and support domestic industry. These policy changes led to reciprocal responses from trade partners, influencing input costs and introducing new pressures into global supply chains. As with similar episodes in recent history, these developments echoed through financial markets and were reflected in the behavior of different asset classes. This article explores how market participants responded during the first 22 trading days following the announcement by examining three primary indicators: U.S. Treasury securities, gold and silver, and the U.S. Dollar Index (DXY).

For broader context, this analysis examines and compares the initial market reactions following four key economic events:

- Case I: Tariffs measures (April 2, 2025 – U.S. announced tariff measures).

- Case II: Covid-19 (March 23, 2020 – U.S. Federal Reserve emergency interventions).

- Case III: The global financial crisis (GFC) (September 15, 2008 – Lehman Brothers’ bankruptcy).

- Case IV: Russian default (August 17, 1998 – Sovereign debt default and ruble devaluation).

The focus is on initial market responses rather than long-term trends, offering insights into how perceptions shift during the early stages of uncertainty.

Observations Across Asset Classes

- United States Treasury Securities:

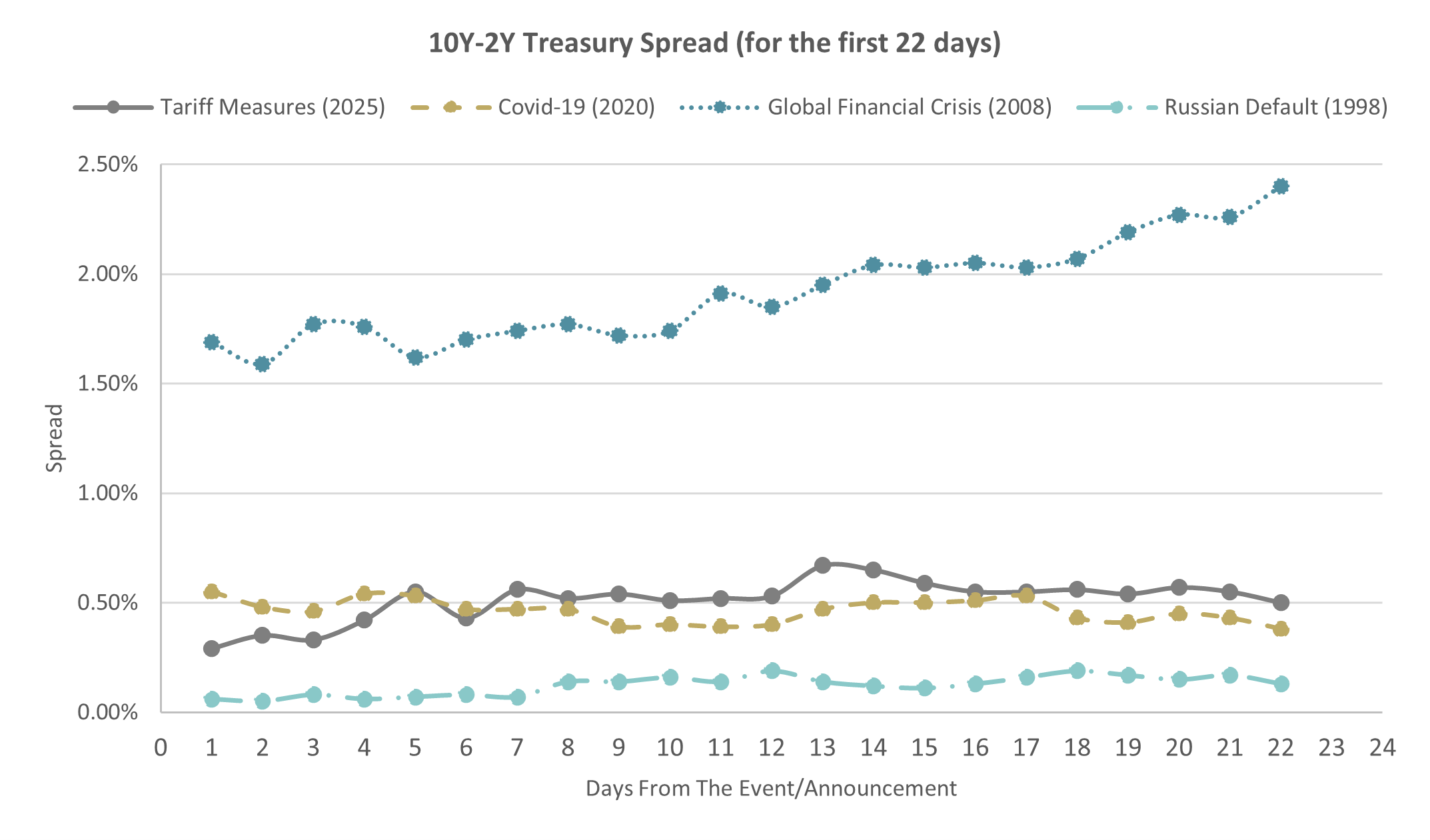

U.S. Treasury securities are widely regarded as among the safest instruments in global markets and serve as a key benchmark for assessing market credit conditions and investor expectations around future monetary policy. One insightful way to interpret Treasury yields is by examining the spread between different maturities. A commonly used indicator is the 2-year and 10-year yield spread, which reflects the difference between short- and long-term interest rates. A widening spread typically suggests optimism about economic growth and rising interest rates, while a narrowing spread often signals uncertainty or expectations of slower growth. These market signals usually incorporate expectations around interest rates, inflation, and term premiums. During periods of uncertainty, the shape of the yield curve can offer meaningful insight into investor sentiment. Figure 1 presents the 2–10 year spread over the first 22 business days following each event, helping identify any lagged or immediate market response.

Source: U.S. Department of the Treasury

As shown in the figure, the spread remained relatively narrow in the cases of the Tariff measures, COVID-19, and the Russian default, with similar spread levels (around 50 bps) observed during the early days of the tariff and COVID periods. By contrast, the Global Financial Crisis displayed a notable steepening of the curve, indicating expectations for monetary easing and economic stimulus. This steepening suggests that the market anticipated an active policy response to support recovery.

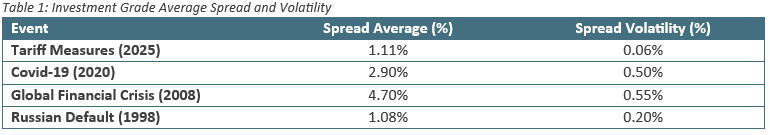

Additionally, comparing corporate bond yields to U.S. Treasury yields provides insight into the credit risk premium investors demand. A narrowing spread typically signals improving confidence in corporate credit or a stronger pursuit of yield. During the first 22 days of each event (as shown in Table 1), the average additional yield for investment-grade bonds relative to Treasuries during the recent tariffs period appears more moderate than in the Covid-19 and Global Financial Crisis at the initial period. Notably, the observed volatility in spreads during the recent tariffs episode has been relatively low compared to the other historical events.

- Gold and Silver:

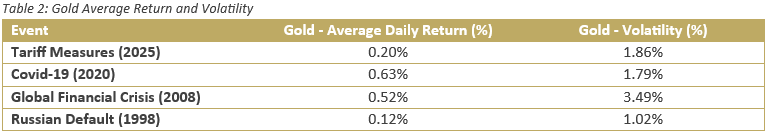

Gold is traditionally perceived as a safe-haven asset, often attracting investors during periods of heightened uncertainty. This tendency was evident again in April 2025, when gold reached record levels (in absolute terms) amid global trade policy shifts. Examining the first 22 trading days after each of the four events, gold posted positive average daily returns across the board—a result that aligns with its historical behavior during episodes of economic uncertainty.

What stands out in this comparison is the similarity in return volatility between the Tariffs case and the COVID-19 period. However, gold was noticeably more volatile during the Global Financial Crisis, suggesting elevated uncertainty and fluctuating investor confidence (in the first 22 days) at that time. The Russian default, on the other hand, saw the lowest volatility and return.

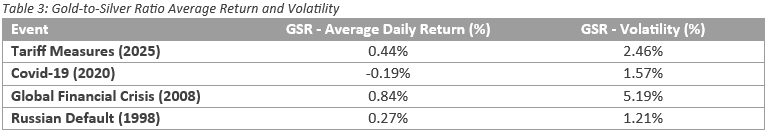

Beyond price behavior, the Gold-to-Silver ratio (GSR) offers additional insight into investor sentiment. A rising GSR typically suggests stronger demand for gold relative to silver, often associated with a defensive market stance. Interestingly, the GSR increased during most of the periods analyzed, except for the COVID-19 case, which saw a modest decline. This could imply a relative recovery in silver or a rebalancing of risk appetite during that time.

- The U.S. Dollar Index (DXY):

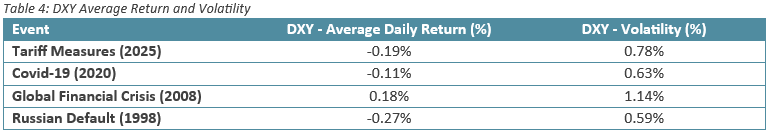

The U.S. Dollar Index (DXY) tracks the performance of the U.S. dollar against a basket of six major currencies: the euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK), and Swiss franc (CHF), with the euro carrying the largest weight. As a widely used indicator, movements in the DXY often reflect global investor sentiment, shifts in capital flows, and the perceived strength of the U.S. dollar relative to the other six currencies. Table 4 below summarizes the average daily return and volatility of the DXY during the first 22 trading days following each event:

Among the four events, the Global Financial Crisis stands out with the highest DXY volatility, possibly reflecting increased demand for U.S. dollar liquidity and heightened global risk aversion during that period. Interestingly, the DXY posted a modest gain in that case, suggesting the dollar’s role as a safe-haven currency was particularly pronounced.

In contrast, the tariff measures in 2025, Covid-19 in 2020 and the Russian default in 1998 were associated with a mild decline in the DXY, perhaps indicating that market participants viewed these events as relatively U.S.-centered or regionally contained.

Navigating Uncertainty

Effective risk management is not something that begins in moments of uncertainty—it should be anchored in a set of guiding principles that shape an organization’s policies and procedures long before volatility arises. In today’s environment, where data is more accessible and technology more advanced than ever, the ability to anticipate and respond to potential disruptions has become a fundamental part of resilience. Establishing thoughtful risk frameworks allows businesses to better navigate periods of economic uncertainity, rather than react to them. This highlights the importance of proactive strategies that help mitigate the impact of market fluctuations and reduce reliance on unpredictable market dynamics.

Conclusion

Looking at how markets behaved in the immediate aftermath of these events offers a window into investor sentiment during the early days of uncertainty. While each episode had different underlying causes and triggered different types of risks, and while asset valuations and market structures may have varied across time, the aim here is not to compare their absolute magnitudes, but rather to observe how the market responded in those initial moments. What stands out across all cases is how distinct the reaction was during the Global Financial Crisis—it registered noticeably higher levels of volatility and risk across nearly every asset class.

It’s worth noting that this analysis captures only a brief snapshot—the first 22 trading days following each event. Longer-term market behavior may tell a different story, shaped by evolving fundamentals and policy responses. And because these events are not isolated in time, lingering effects from one may still be influencing another. With that in mind, these early patterns can be seen as part of a broader narrative about how markets process uncertainty when it first appears on the horizon.