Hawkish FOMC Sentiment Centers Stage

Global economies resume their trip back to normal, inflation pressures persist, U.S. debt ceiling talks drag, and the Chinese real estate giant Evergrande’s “global spillover concerns” arise. Yet, a change in the Federal Reserve tone centered stage over the last few weeks. In this bulletin, we will recap selected events and try to prepare for the journey ahead.

More FOMC Members Turned Hawkish in September

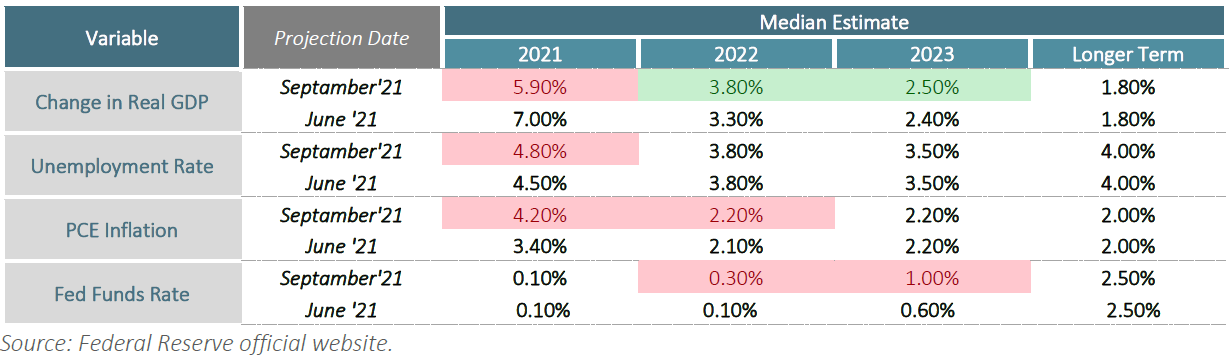

They say some words are more powerful than actions, undoubtedly a valid case for FOMC meetings. Although the U.S. Federal Reserve “The Fed” kept both benchmark rates and asset purchases size unchanged, treasury yields soared as the members’ tone turned hawkish. The 10-year Treasury yield rose more than twenty basis points in the few trading days following the meeting. Market’s reaction was mainly driven by the committee indicating readiness to taper the asset purchases size this year and upwardly revising its projected Fed Funds Rate in 2022 from 0.10% to 0.30%. The Fed’s dot plot now shows 9 of the 18 members expect at least one rate hike by the end of 2022, signaling that a rate hike could happen sooner than previously expected.

The Fed tapering of asset purchases would mean that the monthly $120 billion that is still flowing into markets could gradually vanish. As the Fed reduces its purchases of Treasuries, which is currently kept at $80 billion a month, bond yields (prices) are likely to rise (drop). Unless the interbank offer rates (IBOR) follow, the negative carry associated with interest rate hedges is expected to widen. Noteworthy, the negative carry on SAR 5-year profit rate swap hedges surpassed the 120 basis points barrier following the Fed meeting. Nonetheless, interbank rates will be pressured upward once a rate hike takes place.

Economic Growth Progress and Federal Reserve Projections

As the global vaccination rates continue to rise, economies resumed their trip back to normal. As of the date of writing, 15 out of 20 countries in G-20 surpassed the 50% vaccination rate threshold. This progress in vaccination combined with easing restrictions and recovering risk appetite contributed to economic growth. Nevertheless, we are yet behind pre-pandemic output levels. The U.S. jobs market added 16.5 million jobs between May-2020 and Sep-2021, yet, remained 5.3 million jobs below the pre-pandemic level. Economists are widely predicting that the end of stimulus check in the U.S. would contribute significantly to job market recovery. An argument that is supported by the latest U.S. Labor Department Job Openings and Labor Turnover (JOLT) report, showing job openings stand at a record high level of 10.9 million jobs. On the other hand, inflation readings continued to pressure policymakers, with September reading showing annual PCE standing at the highest level in 30-years. Meanwhile, the moderating jobs recovery kept Fed’s policies unchanged for a while now. However, in a speech following the FOMC meeting, Chair Powell said it would probably take just one “decent” jobs report for the Fed to start reducing its bond purchases. Meanwhile, market participants now keenly await Labor Department’s September jobs report to be published tomorrow.

The below table shows the revised Federal Reserve projections:

Debt Ceiling Concerns

The Republican and Democratic parties in the U.S. ran a political show recently. While Democrats push for a debt ceiling waiver, republicans insist that their counterparts should suspend the debt ceiling on their own as they move to pass an up to $3.5 trillion infrastructure bill. Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, Senate Minority Leader Mitch McConnell, and many others warned that not reaching debt ceiling resolution could seriously affect financial markets.

Despite the catastrophic impact failing to raise or suspend the U.S. debt ceiling could have on global economies, markets remained unwary of a U.S. default event. Since the federal government debt issuance limit was first introduced in 1939, it has been resolved (increased or suspended) more than 90 times, plotting a U.S. default event off historical data chart.

Current Financial Risk Management Priorities

As financial institutions approach the finish line, LIBOR Transition issue is ranked highest for most financial risk managers. Additionally, the ongoing economic readings are now in prime focus as the central banks remain ready to adopt tightening policies. For corporates, we now suggest focusing on business plans progression and the fundamental risk management needs. Shifting the focus to the still cloudy market outlook could push to adopting unnecessary and ineffective hedging strategies.