Mitigating Risks in a Shifting Interest Rate Environment

The year 2024 has witnessed significant changes in global financial markets, as central banks in major economies—such as the Saudi Central Bank (SAMA), the U.S. Federal Reserve, the European Central Bank (ECB), and the Bank of England (BoE)—have adjusted their monetary policies in response to evolving economic conditions. The driving force behind these adjustments has primarily been the need to combat inflation while supporting economic recovery. These policy shifts impacted various aspects of the financial markets, including borrowing costs, liquidity conditions, and exchange rate fluctuations. This article explores the recent interest rate adjustments made by these central banks and offers insights on how to effectively manage the associated risks from these rate changes.

Navigating Interest Rate Adjustments: Insights from Major Central Banks

Saudi Central Bank (SAMA):

In 2024, the Saudi Central Bank (SAMA) made several notable interest rate adjustments to maintain economic stability in the Kingdom and aligning with global monetary trends. When the U.S. Federal Reserve announced a rate cut in September 2024, SAMA responded by reducing its Repurchase Agreement (Repo) rate by 50 basis points to 5.50%. With further rate cuts in the following months, SAMA lowered the Repo rate twice by 25 bps. Where the Repo currently stands at 5.00%.

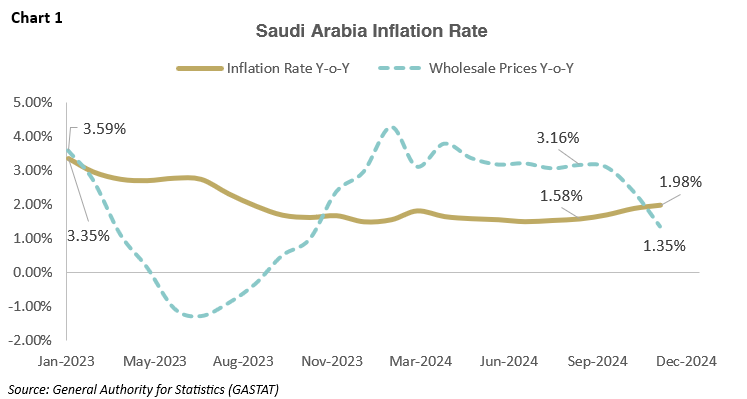

Despite the challenges posed by inflation since the COVID-19 pandemic, Saudi Arabia’s inflation rate remained stable throughout 2024. As shown in Chart 1, the inflation rate has gradually decreased since early 2023, and in 2024 remained below 2.00%, with the latest data for November 2024 showing that the inflation rate has reached 1.98%.

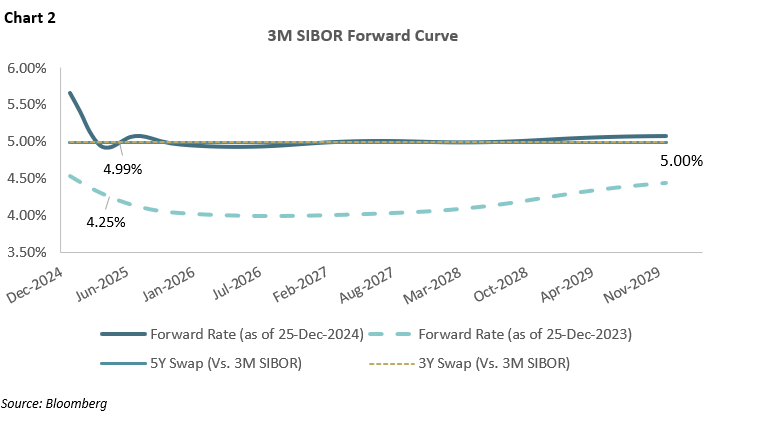

Chart 2 illustrates recent movements in the SAR 3M SAIBOR forward curve. Notably, the forward curve is inverted for the first six months of 2025, with medium- and long-term rates lower than near-term rates. Beyond this period, the curve flattens, stabilizing around 5.00%. Consequently, the 3-year swap is priced nearly the same as the 5-year swap at 5.00%, reflecting the curve’s behavior. The shape and volatility of the forward curve are the key factors that determine the price of interest rate derivatives.

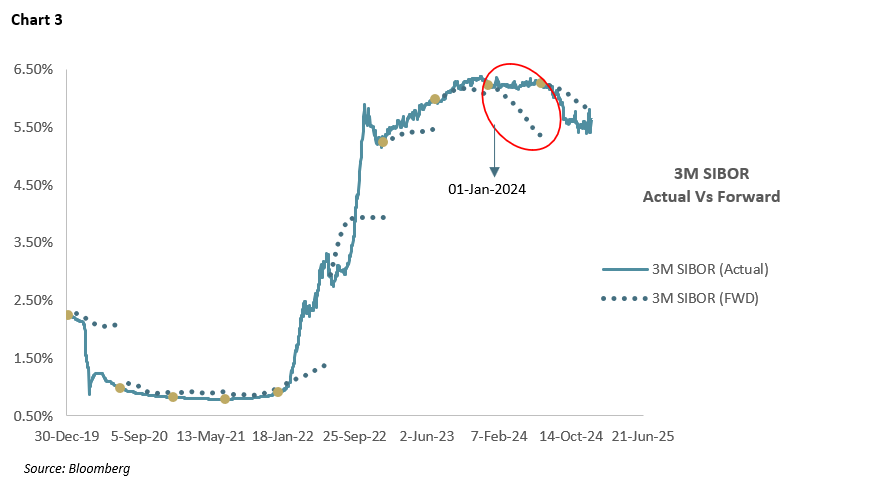

While the forward curve provides a snapshot of market expectations regarding future interest rate movements at a specific point in time, it is inherently volatile and not necessarily realized. Chart 3 illustrates the actual 3M SAIBOR compared to the forward rates projected six months in advance. For instance, on January 1, 2024, the curve shows a decline of 88 basis points in the 3M SAIBOR by July 1, 2024. However, the rate remained stable around 6.23%. This confirms that relying solely on expectations and awaiting rate movements can expose businesses to unnecessary risks. It is essential for businesses to proactively plan and implement strategies to mitigate such uncertainties.

U.S. Federal Reserve:

The U.S. Federal Reserve reduced the interest rate to near zero-levels, in response to the COVID-19 pandemic. This reduction was followed by a tightening cycle where the Fed raised the federal benchmark rate to be within the 5.25%-5.50% range for eight consecutive meetings. The Fed maintained this range until they introduced the first rate cut of 50 basis points (bps) in September 2024 and followed it by two cuts of 25 bps in the following months, bringing the borrowing costs to the 4.25%-4.5% range.

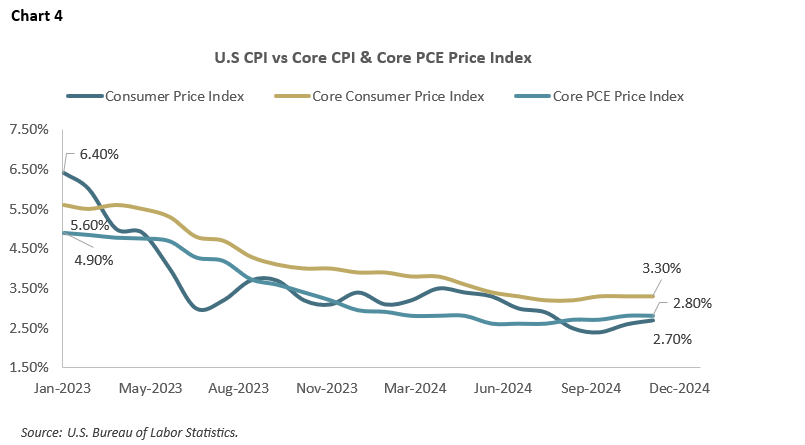

These rate adjustments in 2024 represent a shift in the Fed’s monetary policy, moving away from the extended period of tightening, as inflationary pressure appears to be reducing. The ICE BofA US High Yield Index Option-Adjusted Spread, which is a key indicator of credit market sentiment, also narrowed from 3.39% on 31-Dec-2023 to 2.85% on 23-Dec-2024, signaling improved investor confidence in high-yield debt as the Fed’s actions were perceived to support economic recovery. However, as shown in Chart 4, the Fed’s preferred inflation gauge which is the core Personal Consumption Expenditure (PCE) Price Index, stood at 2.8% in November 2024, still above the Fed’s long-term target of 2%. Additionally, the Fed’s policymakers have stated that they will continue to monitor market data closely, ensuring its decisions are informed by evolving economic conditions.

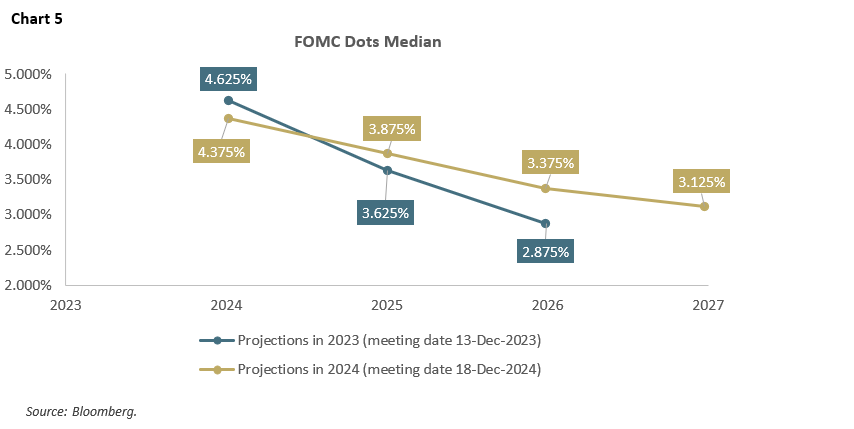

Looking at Chart 5, which shows the Federal Market Open Committee (FOMC) dot plot, the plot shows the Federal Reserve’s interest rate projections for the coming years, with figures from 2023 and 2024 offering insights into their monetary policy outlook. The difference in projections between these two meetings indicates a shift in the Fed’s stance, with initial expectations for larger rate cuts now adjusted to a more conservative approach. This change reflects the Fed’s concerns over inflation and the importance of maintaining price stability.

European Central Bank (ECB):

In response to persistent inflation, which reached 10.6% in October 2022, the European Central Bank (ECB) raised interest rates to curb inflation, driven by volatile energy prices and supply chain disruptions. In June 2024, the ECB reversed its stance, cutting rates by 25 basis points to 4.25%, and further reduced the rate to 3.15% by December 2024. These cuts signaled a more cautious approach, with the ECB indicating future rate hikes would likely be more gradual. The revised 2025 GDP growth projection for the Eurozone is 1.2%, reflecting the impact of tighter monetary policy. Looking to 2025, inflation is expected to remain above the 2% target early in the year but gradually ease as the ECB balances growth and inflation.

Bank of England (BoE):

The Bank of England has made a series of rate cuts in 2024, reducing the base rate from 5.25% to 4.75% by November. However, by November, the inflation rate had increased and reached 2.6%, exceeding the 2% target. This prompted the Monetary Policy Committee (MPC) to maintain the base rate at 4.75% in December 2024. The BoE projects that inflation will increase to 2.75% in the first half of 2025, before reducing and reaching the 2% target. The MPC plans to adopt a gradual approach to monetary policy similar to the other major central banks.

Risk Management in a Changing Market

Recent global changes and adjustments in interest rates highlight the critical need for effective interest rate risk management to protect businesses financially. The timing and pace of future adjustments remain uncertain which exposes businesses to potential risks, such as mismatches in funding costs or fluctuations in asset valuations. This emphasizes the need for strategies that mitigate the impact of interest rate movements and reduce dependence on unpredictable market expectations.

Prudent risk management involves not only reacting to market shifts, but it also involves proactively managing risks through robust hedging strategies and adopting dynamic hedging policies. This can include the use of interest rate derivatives or adjusting debt structures to better align with market conditions. Such measures help businesses shield themselves from the negative consequences of rate fluctuations, enabling them to adjust their financing strategies as needed.

Conclusion: Navigating Uncertainty and Building Resilience in 2025

As we look forward to 2025, the landscape for interest rates remains uncertain, shaped by inflationary pressures, economic recovery, and global monetary policies. The central banks’ decisions to adjust interest rates reflect a delicate balancing act, aiming to support economic growth while managing inflation. This highlights the importance of incorporating interest rate risk management into strategic planning. For businesses and corporations, staying informed and flexible will be key to navigating these uncertainties, ensuring resilience in an ever-changing economic environment.