Interest Rate Outlook: What Lies Ahead?

Since 2020, the interest rate landscape has undergone a remarkable transformation. In response to the COVID-19 pandemic, the U.S. Federal Reserve (Fed) took swift and aggressive action by cutting rates to near-zero levels. This was followed by an unprecedented tightening cycle aimed at curbing inflation. After implementing 11 rate hikes, the Fed maintained its benchmark federal funds rate within the 5.25%-5.50% range for eight consecutive meetings. However, during the September 2024 meeting, the Fed introduced its first rate cut of 50 basis points (bps), citing progress toward its 2% inflation target and balanced risks regarding employment and inflation. Markets were split on whether the Fed would opt for a typical 25 bps cut or take a larger step with 50 bps. The current target range now stands at 4.75%-5.00%. With this backdrop, it is essential to analyze how rates have evolved, the key drivers behind these changes, and what the future may hold for interest rate movements.

Major Factors Shaping the U.S Interest Rate Trajectory 2020-2024

In 2020, as the COVID-19 pandemic brought global economic activity to a standstill, the Federal Reserve swiftly lowered interest rates to near-zero (0%-0.25%) in an effort to stimulate growth. The aim was to encourage borrowing and spending to avoid a severe recession. However, this highly accommodative monetary policy, alongside fiscal stimulus packages and supply chain disruptions, contributed to rising inflation. Now, let’s examine the key factors that influenced interest rate trends from January 2020 to September 2024.

Inflation:

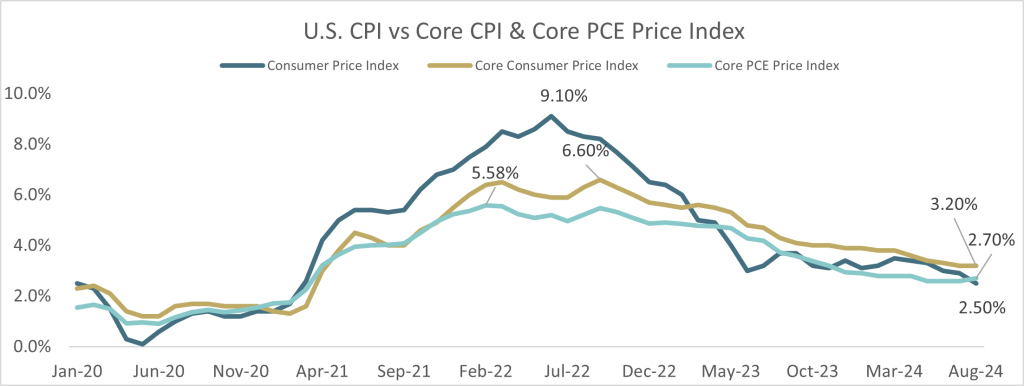

Inflation has been a dominant concern in recent years. As shown in Chart 1, headline inflation in the U.S., as measured by the Consumer Price Index (CPI), peaked at over 9% in June 2022, driven by supply chain disruptions, energy price shocks, and strong consumer demand. Core inflation, which excludes volatile energy and food prices, also surged, especially in sectors like housing and services. Despite cooling headline inflation, the core CPI remains elevated above 3%, leading to ongoing concerns about long-term price stability. Additionally, the Fed’s preferred inflation gauge which is the core Personal Consumption Expenditure (PCE) Price Index, stood at 2.7% in August 2024, down from its peak of 5.6% in March 2022, but still above the Fed’s long-term target of 2%.

Source: U.S Bureau of Labor Statistics.

GDP:

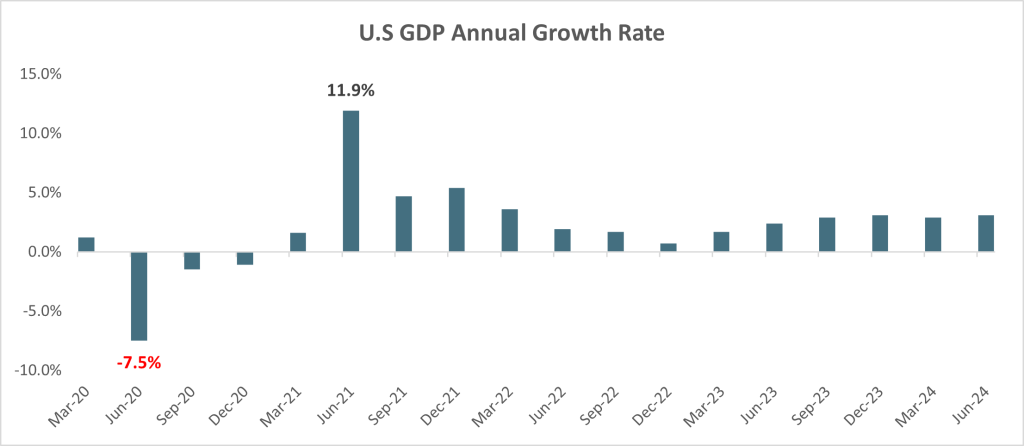

Following a deep contraction in 2020 caused by the COVID-19 pandemic, U.S. GDP growth rebounded sharply in 2021. This recovery was largely driven by unprecedented levels of government spending, stimulus packages, and strong consumer demand. However, in 2022 and 2023, growth began to moderate as the Federal Reserve implemented aggressive interest rate hikes to combat rising inflation.

While growth has slowed, the economy has been more resilient than expected, with no significant recession so far. The contributing factors to this unexpected robustness include a tight labor market, steady wage growth, and ongoing consumer spending.

Source: U.S. Bureau of Economic Analysis.

Unemployment:

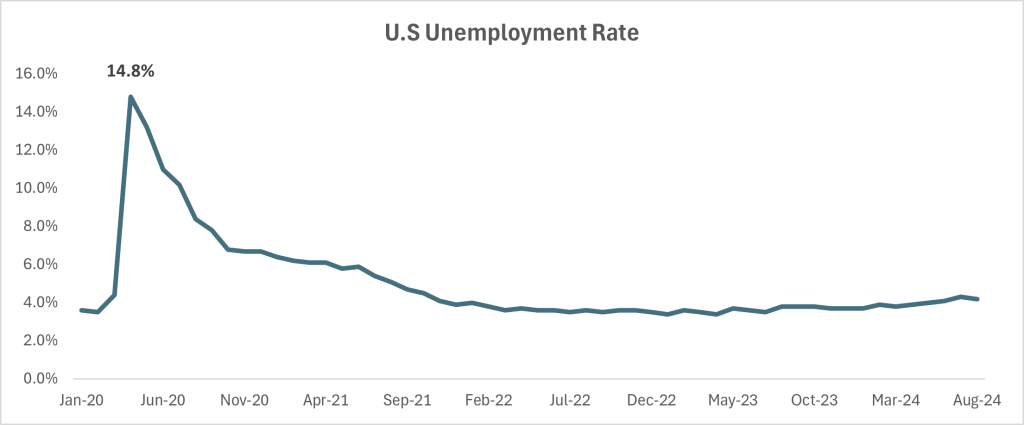

Despite aggressive rate hikes, the U.S. labor market has remained surprisingly strong. Despite peaking in April 2020, unemployment rates decreased gradually in 2021 and have stayed low since then, and job creation has continued. This labor market strength has been a key factor in the Fed’s ability to hike rates without tipping the economy into recession.

Source: U.S Bureau of Labor Statistics.

External Factors:

In addition to domestic pressures, external factors such as geopolitical conflicts, the global energy crisis, and volatile commodity prices have significantly impacted the Federal Reserve’s policy decisions. These conditions added layers of complexity to inflation management and economic growth, leading to uncertainty in the interest rate outlook.

The Road Ahead: Exploring the Potential Trajectory

The September 2024 rate cut suggests a potential shift in the Fed’s strategy, but it may not necessarily mark the beginning of an aggressive easing cycle. According to updated Fed projections, a more measured approach is expected in upcoming meetings, including a 25 bps reduction in the remaining two meetings of 2024. The Fed also anticipates a year-end federal funds rate of 3.25%-3.50% for 2025. While this represents a significant drop from the previous forecast of 4.00%-4.25%, it remains higher than recent market expectations, which anticipated a rate of 2.75%-3.00% by the end of 2025. It is essential to consider key factors that could shape the future trajectory of U.S. interest rate, such as:

Inflation Trends: Although headline inflation has moderated, core inflation remains a key concern. The Fed now anticipates a faster slowdown in inflation than previously projected. The core PCE price index is expected to reach 2.6% in 2024, down from the June forecast of 2.8%. For 2025, inflation is predicted to decline to 2.2%, compared to the prior estimate of 2.3%, with further easing to the 2% target by 2026, in line with previous forecasts. The Fed will likely continue closely monitoring price stability, and, if core inflation remains elevated it could delay additional rate cuts.

Economic Growth: As stated by Fed Chairman Jerome Powell, “Recent indicators suggest that economic activity has continued to expand at a solid pace. GDP rose at an annual rate of 2.2% in the first half of the year”. The Fed’s new forecasts show it still expects the economy to continue growing at 2% for 2024 and maintaining this pace through 2027. The Fed will also watch for signs of a significant economic slowdown. If GDP growth continues to decelerate, there may be pressure to reduce rates further to stimulate demand. However, a resilient labor market could delay these decisions.

Employment: According to the Chairman of the Fed, Jerome Powell, “Fed is not lowering interest rates because it believed the economy was in trouble but because inflation and the labor market were more in balance”. The latest projections indicated that the Fed is preparing for weakness in the labor market. For 2024, Fed sees the unemployment rate at 4.4% for 2024, up from a prior forecast of 4%. The unemployment rate is expected to remain at 4.4% in 2025, up from a prior estimate of 4.2%, and fall to 4.3% in 2026, up from 4.1% previously. Thus, employment trends would also influence the Fed’s decisions regarding interest rates, Fed would assess how employment trends align with its broader goals of managing inflation and supporting sustainable economic growth.

Global Economic Conditions: Global macroeconomic factors—such as supply chain dynamics, energy prices, and geopolitical risks, will continue to play a role in shaping U.S. monetary policy. Any external shocks, particularly from large economies like China or the Eurozone, could disrupt the Fed’s interest rate plans.

Given this backdrop, it is possible that the Fed could adopt a “wait-and-see” approach, cutting rates gradually while keeping a close eye on inflation and growth dynamics.

Major Central Banks Interest Rate Prospects

The European Central Bank (ECB) is cautiously moving toward easing policies, embarking on a rate-cutting path, reducing its deposit rate by 25 bps to 3.50% in September 2024. This was the second rate cut this year. However, the ECB has been vague about the timing of further cuts. The ECB remains concerned about inflation volatility and tepid eurozone growth, with labor costs still above their target range.

The Bank of England (BoE) delivered its first rate cut of 25 bps in August 2024. However, in its September 2024 meeting, BoE decided to maintain its interest rates to keep the base rate unchanged at 5%. The bank is cautious about reducing rates too quickly as BoE’s focus remains on managing inflation, which remains higher than desired. The U.K.’s annual inflation rate rose to 2.2% in August, while core inflation—which excludes energy and food costs—rose to 3.6%. The BoE will likely take a conservative stance on further cuts, especially given the ongoing pressure on core prices and the possibility of wage-driven inflation.

The Bank of Japan (BOJ) as widely expected, left interest rates unchanged at around 0.25% in its most recent September 2024 meeting. The BoJ signaled it was in no rush to raise borrowing costs further. The BOJ governor emphasized the need for caution due to unstable financial markets and the uncertainty surrounding the U.S. economy’s ability to achieve a soft landing. He highlighted that global economic conditions remain highly uncertain, requiring careful monitoring, before deciding on further rate hikes.

Conclusion: A Risk Management Perspective

While there is growing anticipation of rate cuts by the Federal Reserve, it looks like we are moving into the next phase of the interest rate cycle. However, the timing and pace of such adjustments remain uncertain. Therefore, managing interest rate risk becomes paramount and businesses and individuals must adopt effective risk management strategies to mitigate interest rate exposure. A proactive risk management approach involves establishing interest rate hedging policy, adopting hedging strategies, stress testing financial positions, scenario planning and maintaining flexibility. By taking these steps, end users can navigate the uncertainties ahead and position themselves to better withstand future interest rate fluctuations. Lastly, regularly reviewing and adjusting risk management practices in response to changing market conditions will be critical for long-term financial stability.