Navigating Corporate Debt: A Practical Guide to Borrow, Restructure, and Retire

In an ever-changing financial environment, managing corporate debt effectively is more than just about fulfilling obligations—it is a critical strategy for driving growth, managing risks, and enhancing overall value. Whether you’re an investor, a business leader, or someone actively involved in corporate finance, understanding the timing and nuances behind borrowing, restructuring, and retiring debt is essential. This article examines advanced financial metrics, risk management techniques, and regulatory influences that shape successful debt strategies, emphasizing bank financing while also noting capital market alternatives when relevant. Additionally, modern technology—including real-time data analytics and monitoring tools—plays an increasingly vital role in empowering companies to make informed decisions.

Deciding When to Borrow

Borrowing can be a powerful tool to fuel business expansion, support strategic investments, and optimize a company’s capital structure. However, making sound borrowing decisions requires a data-informed approach that goes beyond simple cost comparisons.

Financial Ratios:

Key ratios—such as the Weighted Average Cost of Capital (WACC), Return on Investment (ROI), Debt-to-EBITDA, and interest coverage—play an integral role. For example, if a project’s ROI exceeds the WACC, it indicates that the expected returns will more than cover the overall cost of capital, making additional borrowing an attractive option. A moderate Debt-to-EBITDA ratio combined with strong interest coverage suggests that the firm can comfortably service new debt. In essence, when ROI is higher than WACC and the leverage ratios are within a healthy range, the environment is favorable for borrowing.

Assessing Your Creditworthiness:

Beyond these numbers, evaluating your company’s creditworthiness is essential. A robust financial profile helps secure favorable loan terms from banks and acts as a key indicator of borrowing viability. Lenders examine historical performance and current financial health to ensure that any new debt is manageable, confirming that favorable ratios are supported by an overall strong financial history.

Assessing Market Conditions:

Favorable market conditions involve more than just low interest rates. By employing sophisticated analytics, companies can determine the best timing for issuing debt based on investor sentiment and evolving credit spreads. Alternative financing methods—like private placements or syndicated loans—can also offer flexible options that align with strategic goals.

Evaluating Growth Opportunities:

Borrowing should be directly linked to high-return projects. Integrating real-time data analytics into the investment evaluation process helps ensure that potential cash flows will significantly exceed the weighted average cost of capital (WACC) even under varied economic conditions.

Knowing When to Restructure Your Debt

Even companies with robust debt portfolios may need to adjust their liabilities as market conditions shift, regulatory requirements evolve, or business models change. Proactive debt restructuring can protect liquidity and secure long-term financial stability.

Financial Ratios:

Monitoring key ratios such as Debt-to-EBITDA and WACC provides early warning signs that existing debt is becoming burdensome. For example, if the Debt-to-EBITDA ratio begins to rise and the WACC increases, it signals that the cost of carrying debt is eroding profitability. These trends suggest that the current debt structure is less sustainable and may warrant restructuring.

Covenant and Regulatory Considerations:

Alongside the numbers, maintaining compliance with bank-imposed covenants is critical. Proactive restructuring—whether through renegotiating terms, extending maturities, or adjusting the mix between fixed and variable rates—can preempt breaches that might trigger penalties or force refinancing under less favorable conditions. Regular reassessment against evolving regulatory frameworks ensures that the debt structure remains aligned with internal strategic goals and market standards.

Determining When to Retire Debt

Retiring debt is not merely a defensive measure; it is also a strategic decision that can reduce interest burdens, improve financial strength, and enhance market positioning.

Financial Ratios:

Evaluating improvements in key ratios—such as enhanced interest coverage and a lower Debt-to-EBITDA—can indicate that conditions are favorable for early debt retirement. When these metrics show significant improvement, it suggests that the company is in a strong position to reduce its leverage and lower its financing costs.

Evaluating Surplus Liquidity and ROI:

If a company generates healthy cash flows, retiring high-cost debt can be a wise move. A detailed comparison of the ROI from core operations versus the cost of servicing debt helps determine whether maintaining debt is more costly than its benefits. Strategic debt paydowns not only improve the balance sheet but also position the firm for more favorable terms in future financing rounds.

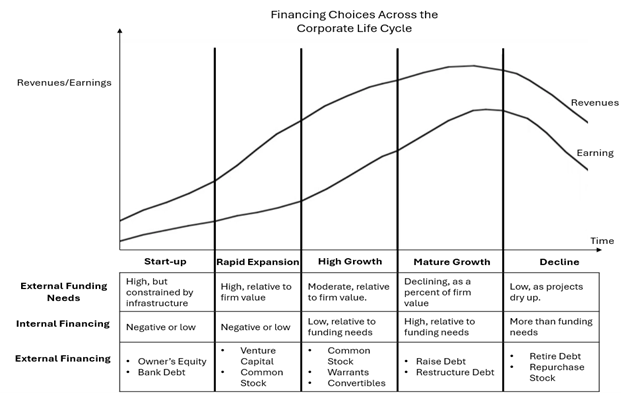

Financing choices are dynamic and must align with both the company’s stage of development and its strategic objectives, the following graph illustrates how financing choices evolve throughout a company’s life cycle. It highlights how changes in revenues, risk profiles, and market conditions drive strategic decisions regarding borrowing, restructuring, or retiring debt.

Inspired by the framework popularized by Aswath Damodaran

Embracing Technology and Real-Time Analytics

Modern debt management increasingly relies on data and advanced technology to refine decision-making. The integration of financial technology solutions and real-time monitoring systems empowers companies to remain agile and make informed strategic choices.

Harnessing Data Analytics:

Cutting-edge algorithms can analyze cash flow patterns and market trends to flag potential refinancing or debt retirement opportunities. These tools enhance forecasting accuracy, enabling companies to react swiftly to economic changes.

Real-Time Monitoring Tools:

Dashboards that provide up-to-the-minute updates on interest rates, credit spreads, and debt maturities ensure that decisions are made based on the most current market data. This continuous oversight is crucial for timely adjustments to the debt portfolio, keeping strategies aligned with market realities.

Conclusion: Navigating Uncertainty and Building Resilience in 2025

Managing corporate debt is a dynamic process that demands a balanced interplay of financial analytics, market insights, and regulatory awareness. By integrating a concise review of key financial ratios with a thorough assessment of overall financial strength, market conditions, and covenant compliance, companies can optimize their capital structures and reduce financing costs. Moreover, leveraging modern technology through data analytics and real-time monitoring tools ensures that decisions are based on the latest market insights, enabling companies to adapt swiftly to market shifts, seize growth opportunities, and maintain a competitive edge in an ever-evolving landscape.