Navigating Post-Inflation Risks through Risk Management

The transition from peak inflation to a facade of stability is a deceptive calm, masking a complex interplay of residual vulnerabilities. While headline inflation figures may suggest a return to normalcy, the economic landscape is scarred by the enduring legacies of the inflationary surge. The rapid ascent and subsequent deceleration of prices have created a ‘whiplash effect,’ leaving businesses and consumers grappling with a distorted cost structure. Persistent core inflation, particularly in essential sectors like housing and food, signals that the underlying inflationary pressures haven’t fully dissipated, potentially leading to a ‘sticky inflation’ scenario where prices remain elevated despite overall moderation. The elevated debt burdens accumulated during the high-interest-rate regime pose a significant systemic risk, as companies face refinancing cliffs and heightened default probabilities. This period demands a shift from reactive to proactive risk management, emphasizing stress testing for a range of ‘tail risks’—low-probability, high-impact events—and building resilience against the prolonged uncertainty that characterizes the post-inflationary environment.

Inflation landscape

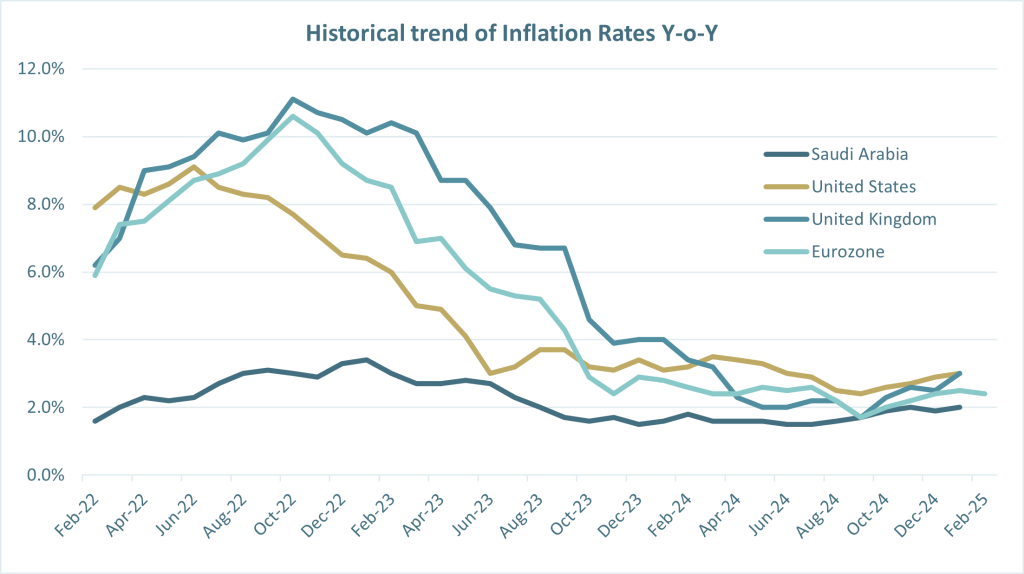

During the COVID-19 pandemic, global inflation remained relatively low due to weakened consumer demand and economic contraction. However, as economies reopened, a surge in inflation took hold in 2022 and 2023, driven by supply chain disruptions, rising energy costs, and aggressive monetary stimulus. The United States saw inflation peak at 9.1% in June 2022, marking the highest level since 1981. Similarly, the United Kingdom and the Eurozone faced inflationary spikes, with UK inflation reaching 11.1% in October 2022 and the Eurozone peaking at 10.6% in the same month. While Saudi Arabia experienced a more muted inflationary trend, it still recorded an increase from 1.6% in early 2022 to a peak of 3.4% in January 2023, driven by rising housing costs.

Since these peaks, inflation rates have moderated, with the US declining to 3.0% by January 2025, the UK stabilizing at 3.0%, and the Eurozone easing to 2.5%. Saudi Arabia has maintained relatively lower inflation, hovering around 2.0%. However, the post-inflation period presents unique risks that businesses and financial institutions must navigate. Persistent cost pressures, especially in sectors like housing and food, continue to strain corporate margins and consumer purchasing power. Furthermore, the sharp decline in inflation does not immediately reverse the effects of high borrowing costs incurred during the peak period, increasing debt burdens and refinancing challenges. Additionally, asset valuations, particularly in real estate and equities, remain vulnerable to corrections as central banks maintain a cautious approach to interest rates. These factors underscore the need for dynamic risk management frameworks, continuous monitoring, and robust governance structures to mitigate financial instability in the post-inflation era.

The Lingering Risks After High Inflation

Once inflation is under control, the risks companies face are not necessarily mitigated simply because inflationary pressures have abated. Elevated prices for goods and services remain a reality, and businesses must continue to operate in a world where certain costs are likely to remain high. These persistent challenges pose unique risks to businesses that must be carefully managed through robust hedging and risk management strategies.

Sticky Prices and Ongoing Cost Pressures

- Despite inflation rates stabilizing, prices for goods and services often remain higher than pre-inflation levels. Businesses, particularly those with large exposure to raw materials or labor-intensive industries, must continue to navigate this challenge.

- Hedging against Input Cost Volatility: One of the most effective ways to manage the ongoing impact of sticky prices is to use hedging strategies that mitigate the volatility in key inputs. For instance, businesses can use commodity futures, options, or forward contracts to lock in prices for essential raw materials or energy costs. This strategy not only provides cost predictability but also protects against the possibility of price hikes when inflationary pressures resurface.

- Currency and Inflation-Linked Hedging: With inflation and interest rates varying across regions, businesses with international operations may need to hedge against currency risks as well. Inflation-linked derivatives (e.g., inflation swaps) can help hedge against the risk of rising costs in markets with ongoing inflation, especially where local currencies are devaluing in real terms.

Credit Risk and Debt Management Post-Inflation

- In the aftermath of inflation, businesses and financial institutions may find that previously affordable debt becomes more expensive to service due to higher interest rates. Additionally, companies with significant debt exposure could struggle with refinancing in a more expensive borrowing environment.

- Interest Rate Hedging: Given the likelihood of central banks maintaining elevated interest rates to prevent inflation from resurging, businesses with variable-rate debt or upcoming debt maturities need to mitigate the risk of higher borrowing costs. Interest rate swaps and options are essential tools to lock in borrowing costs or cap the interest rate exposure, providing greater certainty over future debt servicing.

- Debt Refinancing Strategies: Hedging strategies related to debt refinancing are equally crucial. Companies can use forward rate agreements or interest rate swaps to smooth out the refinancing process, ensuring that they can handle rising rates without significant liquidity strain. Properly managing the debt profile with these tools can help mitigate refinancing risk during uncertain economic times.

Asset Price Devaluation and Market Risk

- The post-inflation environment often sees asset prices—whether in real estate, equities, or commodities—remain inflated even after inflation is controlled. However, the subsequent correction of these prices can lead to financial risks for businesses holding these assets.

- Equity and Real Estate Hedging: To protect against the risk of asset devaluation, businesses can employ equity index futures or options to hedge against market volatility. Similarly, in the real estate sector, businesses holding commercial property or real estate assets may use interest rate derivatives or property derivatives to hedge against potential declines in asset values.

- Diversification and Risk Transfer: The strategic use of diversification remains a key part of hedging. By diversifying into different asset classes—whether through commodities, bonds, or other financial instruments—businesses can spread risk and reduce exposure to asset-specific devaluation. Additionally, businesses should explore risk transfer mechanisms such as insurance-linked securities (ILS) to mitigate the long-term risks of holding overvalued or volatile assets.

Post-Inflation Risk Management Framework: The Role of Governance

When inflationary pressures subside, companies need to ensure that their risk management framework remains robust and dynamic. The risk landscape may have changed, but governance, oversight, and adaptability are more critical than ever.

Governance in Hedging Activities

- Risk management governance must evolve to incorporate the lessons learned during the inflationary period while ensuring that the organization remains prepared for future volatility.

- Clear Policies and Objectives: The first step is establishing clear policies around hedging activities. Companies must define what risks are acceptable, which instruments should be used, and the level of exposure the business is willing to tolerate. These policies should be reviewed regularly, especially when transitioning from an inflationary to a post-inflation environment.

- Risk Limits and Controls: Ensuring the effectiveness of hedging requires setting and adhering to risk limits for each hedging instrument used. This includes determining the notional amounts, tenor, and hedging ratios that align with the organization’s risk appetite and overall financial strategy. Importantly, there should be oversight mechanisms in place to monitor these limits on an ongoing basis.

Risk Monitoring and Real-Time Adjustments

- As the business navigates through the post-inflation period, it is crucial to continue monitoring both the effectiveness of the hedging strategies in place and the changing risk environment. This includes real-time tracking of inflation trends, interest rate movements, and price fluctuations.

- Dynamic Risk Models: Employing dynamic, data-driven risk models that adjust based on real-time data and market movements is crucial. These models can help companies identify shifts in risk exposure quickly, allowing for timely adjustments to hedging strategies.

- Scenario Analysis and Stress Testing: Stress testing remains a valuable tool for businesses during the post-inflation period. By running various economic scenarios, businesses can assess the impact of potential interest rate hikes, changes in commodity prices, and other macroeconomic factors on their hedging positions and overall financial stability.

Coordination Across Risk Functions

- Risk management in the post-inflation period should not be siloed. The governance structure should ensure that risk management, treasury, and other relevant departments coordinate and share information.

- Cross-Department Collaboration: Treasury departments and risk management teams must work closely to ensure that hedging strategies align with the broader financial goals of the company. Coordination ensures that hedges are not just focused on specific risks (e.g., market prices) but also integrate with the company’s broader risk appetite and business strategy.

- Internal Audit and Compliance: An internal audit function should ensure that hedging strategies comply with both internal policies and external regulatory requirements. This helps reduce operational risks associated with complex hedging transactions.

Conclusion: A Proactive Approach to Post-Inflation Risk Management

The post-inflation period presents its own set of challenges that require proactive hedging strategies, robust risk management, and vigilant oversight. While inflation may be under control, businesses must continue to manage the lasting effects of elevated prices, higher borrowing costs, and market volatility.

As companies continue to implement hedging strategies, the real challenge becomes adapting their risk management framework to this “new normal.” How can businesses build adaptive and resilient risk management frameworks that not only account for the lingering effects of high inflation but also position themselves to succeed in a future where these economic shifts become a permanent part of the financial landscape?

In addition to adopting these strategies, companies will need a risk management tool that can help them continuously monitor and manage the risks in their Debt portfolio and also the risks associated with hedging activities. A robust Risk Management tool that integrates real-time risk data, provides scenario analysis, and offers seamless communication between departments is essential. Such a tool can act as a central hub for tracking the effectiveness of hedging strategies, ensuring that risk limits are adhered to, and enabling timely decision-making based on up-to-date market data. This could play a pivotal role in supporting businesses during this transitional phase, ensuring that they can effectively navigate the complexities of the post-inflation economy while maintaining resilience and agility in their risk management efforts.