Systemic Risks of OTC Derivatives

Financial derivatives offer substantial benefits in hedging against unforeseen risks. Originally, financial derivatives were created solely for this purpose, although their use has since expanded to include speculation and arbitrage. Examples of hedging include, but are not limited to, hedging the fluctuations in interest rates, commodity prices, or foreign exchange rates. Most companies are reluctant to expose themselves to risks that could harm their cash flows or impede their strategic objectives; therefore, prudent management resorts to using either exchange-traded derivatives or over-the-counter (OTC) derivatives to manage risks giving its commercial needs. However, these benefits can only be realized if the financial derivatives are used wisely and prudently. Given that derivatives are inherently complex in their structure, valuation, and trading, the knowledge balance tends to favor financial institutions which sell these derivatives to various commercial and non-commercial entities. While financial derivatives have significant benefits, they also carry substantial risks, and caution should be exercised when dealing with them. In this bulletin, we will focus on the systemic risks arising from over-the-counter (OTC) financial derivatives.

Categories of Over-the-Counter (OTC) Derivative Products by Purpose

Before delving deeper into this bulletin, it is first necessary to understand the main categories of OTC derivative products in terms of their purpose. There are two primary categories of these products:

1- Hedging Products.

2- Speculative Products.

Category One: Hedging Products

These are products designed to protect a company partially or fully against unexpected events. For example, a company with a semi-annual need for a certain commodity worth $100 million (assuming each unit of the commodity is valued at $100) would seek to hedge against price changes of that commodity after six months to align with its commercial needs in the event of a sudden price increase or a change in the foreign exchange rate. The first category is divided into two main types:

Type A. Simple or Plain Hedging Products:

These products are generally straightforward in their structure, pricing, and valuation, and some may not require an upfront payment to enter into, such as Interest Rate Swaps / Cap or outright FX Forwards.

Type B. Structured Hedging Products:

These products are somewhat more complex in their structure, pricing, and valuation. Some of these products may require an upfront payment for purchase, such as a combination of options and features.

Note: It is important to highlight that in the first type, we used the term “enter into”, whereas in the second type, we used “purchase”. The difference is that for some products in the first type, the company only exchanges cash flows with the selling financial institution at agreed-upon intervals, thus the difference between the expected future cash flows represent the company’s profit or loss, so there is no obligation for the company to make an upfront payment for some of these products. However, in the second type, the company pays the selling financial institution a premium for protecting it against variability above an agreed-upon level. The financial institution’s profit is typically a portion of that premium made at the contract’s inception.

Category Two: Speculative Products

These are products that do not align with the company’s commercial needs, or they provide a return with a capped gain when prices move in favor of the company, in exchange of the backdrop of unlimited risks when prices move contrary to the company’s expectations. Unlike the first category, there are no limits to the diversity and complexity of these products. Since they are used for speculation or trading, the structure can be widely varied as they are based on the entity’s objectives.

Below are examples of some options that can be included in a speculative product:

It is reasonable to agree that it would be irrational for the management of any prudent company to engage in the second category, if speculation on price movements does not align with the company’s strategy and policy. Additionally, engaging in the second category entails in some of its structures open-ended risks that could potentially lead to substantial losses, significantly impacting the company’s financial position and cash flows as well as its reputation. If not part of its policy, electric vehicle manufacturers should not engage in speculation or betting on interest rate fluctuations or changes in copper prices, a key component in production. Their primary objective is to hedge against rising interest rates to protect profitability by avoiding higher interest payments on loans. Additionally, they hedge against increasing copper prices to maintain competitive vehicle pricing, thus preventing a potential loss of market share due to decreased competitiveness.

The Contribution of OTC Derivatives to Deepening Systemic Risks in the Financial Sector

Firstly, what are systemic risks in the financial sector? These are risks that could severely impact the financial sector due to the default of numerous commercial or financial entities on their credit obligations at the due date. Such defaults often arise from geopolitical, climatic, or economic crises (such as the 2007-2009 global financial crisis) or health crises (like the COVID-19 pandemic), creating what is known as the “Domino Effect.” Alternatively, they can result from a sharp rise in interest rates due to persistently high inflation rates, as occurred in 2022 when many central banks around the world rapidly and unprecedentedly increased interest rates to combat rampant inflation following the COVID-19 pandemic.

The systemic risks arising from the sale of over-the-counter (OTC) derivatives discussed in this bulletin are meant to refer to the contribution of OTC derivatives (particularly speculative products) in deepening the economic impact within the financial sector during a crisis. For instance, the role of OTC derivatives (speculative products specifically) in deepening the global financial crisis of 2007-2009.

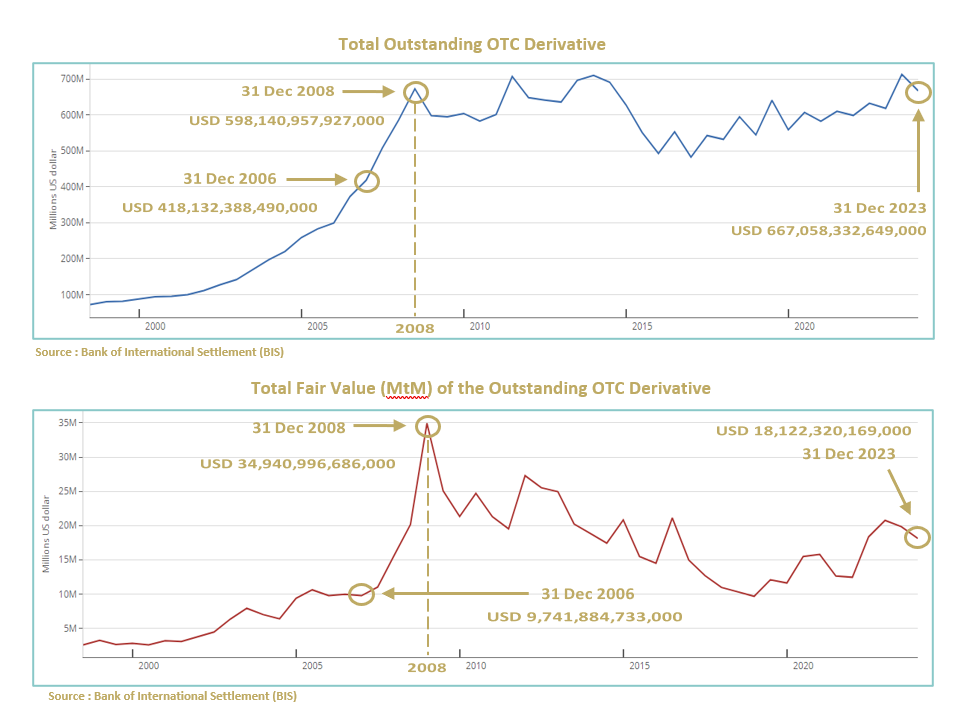

According to the Bank for International Settlements (BIS), as of December 31, 2023, the total outstanding notional amount of all types of OTC derivatives reached USD 667,058,332,649,000 (around six hundred sixty-seven trillion dollars), and the total fair value of the outstanding OTC derivatives on the same date was USD 18,122,320,169,000 (around eighteen trillion dollars). These totals encompass all risk categories, all instruments, all currencies, all maturity dates, all counterparties, all countries, all credit ratings, all economic sectors, and all methods. It is evident from the charts below that entities of various scales consider OTC derivatives for different purposes including hedging.

Less sophisticated entities seeking to hedge might misunderstand the mechanisms of many derivatives, especially the more complex and structured ones described in the second category above. For example, a company might believe that entering into a “Range Accrual Swap” with a range of “0%-3%” and receiving a spread of “0.80%” is hedging, by reducing its interest payments on its loan. In reality, the company is engaging in a risky bet that could result in a significant negative fair value (MtM) if interest rates exceed “3%”.

This is where the role of the company’s governance structure becomes crucial. it needs to verify that the executive management team (specifically the CEO, CFO, CRO, and the Treasurer) understands derivatives when entering into or purchasing them, particularly the second category. For example, if the board is not confident enough in the internal expertise to comprehend complex derivatives, they should consider an appointment of an external advisor specializing in financial derivatives. This will help reduce the risks associated with engaging in speculative products that are irrelevant to the company’s commercial needs or policy.

The question then arises: How do OTC derivatives contribute to deepening systemic risks in the financial sector?

When entering into or purchasing financial derivatives, both parties involved operate under the assumption that the other party will meet its contractual obligations by making the required cash flows on the due date. This assumption holds true under normal market conditions and typical economic circumstances. However, this assumption may not hold in adverse scenarios as both parties will experience uncertainty if a genuine crisis occurs in the financial markets or unexpected economic conditions arise.

Risk models often understate the true magnitude of risks during financial crises. As a result, financial institutions may face heightened counterparty risk due to the extreme adverse conditions. Simultaneously, non-financial counterparties, who may not fully understand the complexities of derivative instruments, are at an increased risk of default. The concurrent occurrence of these factors across numerous derivative contracts can significantly contribute to systemic risks within the financial system.

So, does this mean that entities should avoid hedging through financial derivatives? The answer is certainly no. We encourage all companies with significant exposures to carefully assess these exposures and determine whether hedging is appropriate. Having said that, not all exposures necessarily require hedging, as in some cases, a company may not need to hedge due to natural hedges within its balance sheet or its ability to manage the exposure through acceptance, avoidance, or mitigation, subject to its risk appetite and risk management strategy approved by the board of directors.

Key Takeaways

Over-hedging beyond an entity’s genuine commercial needs can exacerbate its risk exposure, leaving it vulnerable to contractual obligations when they come due. A lack of understanding of the complex nature of certain financial derivatives, combined with unauthorized engagement in speculative instruments, presents a highly dangerous risk profile. Effective financial risk management goes far beyond simply entering into or purchasing derivatives; there are various strategic methods available to manage financial risks more holistically and sustainably.

The real impacts and consequences of systemic risks posed by the inappropriate use of OTC derivatives will not become apparent until a crisis occurs. Like a snowball that forms and rolls gradually, quietly, and without much noise, it is crucial for all market participants to be aware of the double edged role of financial derivatives in potentially deepening systemic risks.