Leveraging Monte Carlo Simulation for Effective Financial Risk Management

In financial risk management, a multitude of mathematical and statistical tools play pivotal roles in analyzing and quantifying uncertainties. These tools are essential for assessing how different risk factors affect entities and financial instruments while offering valuable insights into potential outcomes. They enhance the understanding of financial risk (such as market risk, credit risk, and operational risk) exposures, thereby facilitating informed decision-making amidst financial volatility. Monte Carlo Simulation (MCS) is particularly noteworthy among these tools, enabling a thorough interpretation of data and deeper insights into the impacts of economic and financial variability on financial markets. I will present an overview of Monte Carlo Simulation, explores its applications in financial risk analysis, and examines both its advantages and limitations.

Overview of Monte Carlo Simulation

Imagine an individual planning a road trip but unsure about the travel time due to variable factors like traffic, road conditions, and possible detours. Monte Carlo Simulation would simulate numerous travel scenarios based on historical data and assumptions about the probability distribution of these factors. Each simulation would represent a different combination of these variables, giving a range of possible travel times. By running thousands of these simulations, one can estimate the most likely travel time and understand the probability of encountering delays or arriving early. This approach allows individuals to make informed decisions about when to leave, considering uncertainties that could affect their journey.

Monte Carlo Simulation employs computer algorithms to repeatedly draw random samples from given data based on specific assumptions. This process generates multiple potential outcomes, which we can call paths, derived from the input data and these assumptions. These paths illustrate the probabilities of these outcomes occurring. Assumptions act as guiding rules for the simulation to ensure accurate modelling.

Monte Carlo Simulations are frequently employed to simulate complex problems or estimate variables when data samples are limited. The Simulation’s ability to model uncertainties and provide probabilistic outcomes makes it a versatile tool in risk management across various domains, helping organizations better understand and prepare for potential risks.

Below are brief examples of how Monte Carlo Simulation can be used to analyze different types of financial risks (market risk, credit risk, and operational risk):

- Market Risk:

Monte Carlo Simulation plays a vital role in market risk management through several key applications. It estimates the Value-at-Risk (VaR) by simulating numerous potential future market scenarios, performs stress testing under extreme conditions, and optimizes portfolios to achieve the best risk-return balance. Additionally, it is used to price complex derivatives when analytical solutions are unavailable, aids in managing liquidity risk by simulating potential shortfalls, and facilitates scenario analysis to assess the impact of varying market conditions. Furthermore, it ensures regulatory compliance through detailed risk assessments and stress test results, and tests hedging strategies to evaluate their effectiveness across different market environments.

- Credit Risk:

In credit risk management, Monte Carlo methods simulate the default probabilities of counterparties and the potential exposures associated with a portfolio of loans or bonds. For example, a bank could simulate various economic scenarios and their impact on borrowers’ ability to repay loans. By incorporating variables such as economic indicators (e.g., GDP growth, unemployment rates) and borrower-specific factors (e.g., credit ratings, industry trends), Monte Carlo Simulation can estimate the probability distribution of credit losses. This aids in setting risk-adjusted pricing, provisioning for loan losses, and stress testing the portfolio’s resilience to adverse credit events.

- Operational Risk:

The technique is valuable for assessing operational risk, such as the risk of financial losses arising from inadequate or failed internal processes, systems, or human factors. For instance, a manufacturing company could use Monte Carlo Simulation to model potential disruptions in production due to equipment failures, supply chain delays, or workforce issues. By simulating these operational scenarios and their impacts on production output and costs, the company can quantify the financial risks associated with operational disruptions. This enables proactive risk management strategies.

It’s important to note that these examples are not exhaustive. In addition to the examples mentioned above, Monte Carlo Simulation can be applied to various other areas. For instance, it can be used to model a stressed forward curve (i.e., projecting the future values of interest rates or other financial variables under stressed conditions, which are hypothetical scenarios that represent extreme market movements), or estimate Potential Future Exposure (PFE) in market risk scenarios. For instance, a financial institution might use Monte Carlo Simulation to model its PFE, which is used to estimate the maximum loss that could be incurred on a financial position over a specified time horizon. Its versatility makes it a powerful tool across numerous domains.

Advantages & Limitations of Monte Carlo Simulation

Every mathematical or statistical tool possesses inherent advantages and limitations, regardless of its power or accuracy. These factors can include the availability of reliable data, physical limitations of computer processors, and the necessity for making numerous assumptions. Below are some of the main advantages and limitations of Monte Carlo Simulation:

- Advantages of Monte Carlo Simulation:

- Capability to address complex and uncertain situations:

It enables the inclusion of multiple variables and simulating their uncertainties, offering a more realistic portrayal of the modeled system. For instance, it can incorporate variables such as interest rates and market volatility, empowering decision-makers to grasp the spectrum of possible outcomes and make well-informed decisions.

- Capability to rapidly generate a vast array of scenarios:

By executing thousands or even millions of simulations, decision-makers can gain a thorough grasp of potential outcomes and their respective probabilities. This capability proves invaluable for assessing risks and making informed decisions.

3. Multiple Scenario Analysis:

It provides a robust scenario analysis framework that helps prioritize efforts by identifying key factors and assessing their impact on outputs through varying input variables. This is crucial for complex systems with interconnected, non-linear relationships between variables.

- Limitations of Monte Carlo Simulation:

- The necissity of accurate assumption:

The accuracy of Monte Carlo Simulations depends on the validity of the assumptions and the degree of simplification applied in the model. Inconsistent assumptions or oversimplified models can lead to inaccurate or deceptive simulation outcomes.

- Computationally Intensive

It requires running numerous iterations, which can be computationally demanding and time-consuming. Increasing model complexity and the number of input variables escalates computational needs, potentially restricting the feasibility of Monte Carlo Simulations in some applications.

Monte Carlo Simulation and Financial Derivatives

This section delves into a practical application of Monte Carlo Simulation that I often encounter in my work. The example involves assessing the interest rate swap exposure, specifically using Monte Carlo Simulation to analyze the Mark-to-Market (MTM) movements of an interest rate swap and simulate diverse scenarios under uncertainty.

In this context, we simulate the Mark-to-Market (MTM) fluctuations of an interest rate swap spanning five years, based on quarter-annual SAIBOR (3M-SAIBOR). The objective is to illustrate the impact of varying scenarios driven by SAIBOR fluctuations on the swap’s MTM value. Monte Carlo Simulation employs random sampling to simulate potential outcomes, considering parameters like interest rate volatility and market dynamics. From the model used for pricing (based on Monte Carlo Simulation) and exposure metrics, the number of possible outcomes simulated are more than 10,000 different paths to illustrate the potential MTM distribution of the Interest Rate Swap in the future.

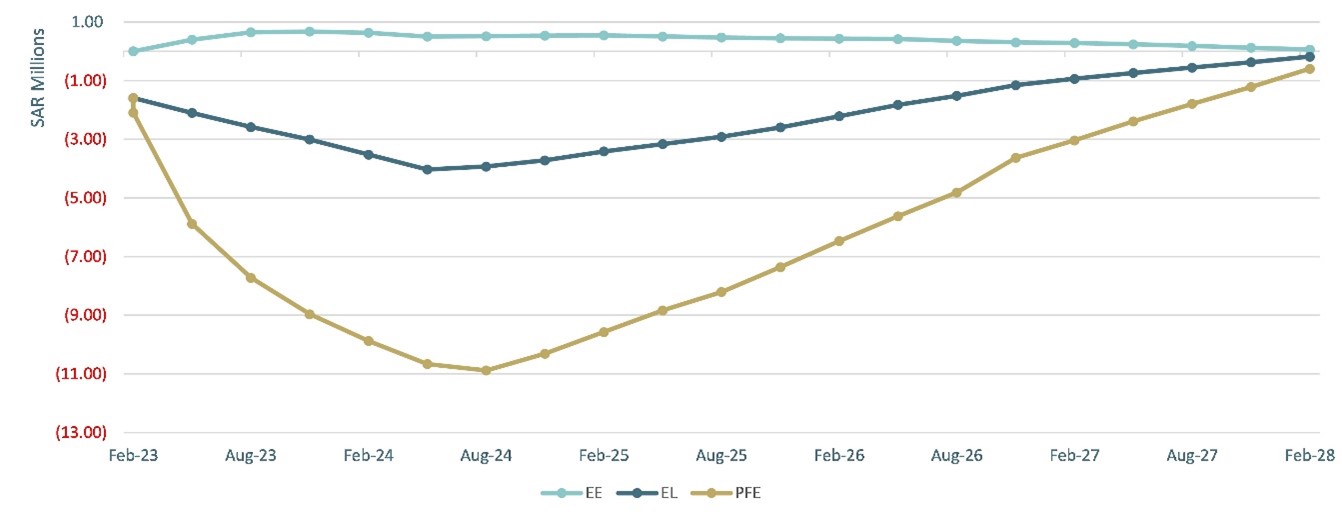

The figure above showcases three key metrics only, extracted from the Monte Carlo simulation; these metrics are:

- PFE: Potential future exposure (“PFE”) is a measure of the worst-case scenario for the swap MTM by applying a 95% confidence interval.

- EE: Expected exposure (EE) indicates the expected positive MTM of the swap throughout the tenor.

- EL: Expected loss (EL) indicates the expected negative MTM of the swap throughout the tenor.

For clarity, only the key metrics were plotted, although the simulation results can display 10,000 outcomes for the MTM movements of the swap. As demonstrated by the PFE profile, there is a 5% chance that the MTM of the swap could reach around negative SAR 11 million by August 2024. On the other hand, the EE indicates that the MTM could reach around positive SAR 673,000 by November 2023.

Monte Carlo Simulation and The Future of Financial Risk

Monte Carlo Simulation is a crucial modeling tool in financial risk management, known for its ability to assess potential financial risks by simulating various scenarios and estimating the impact of different risk factors on portfolios or financial strategies. It effectively handles complex and uncertain conditions by incorporating multiple variables and their uncertainties, offering a reasonable depiction of potential outcomes and interpreting data and grasping economic and financial variability in markets.

The application of computational simulations in financial risk management is increasingly essential and valuable, providing objective insights that enable decision-makers to make crucial, well-informed choices for their businesses. However, these tools should be used when the organization can allocate the right resources efficiently, ensuring they provide added value and help achieve the organization’s business and economic objectives.