KSA Real Estate Financing Considerations (Part 1)

KSA Real Estate Emerging Trends

In recent times, the Kingdom has witnessed an unprecedented flurry of activities across all segments and sectors of real estate. In line with Vision 2030, concerted government initiatives through Ministry of Housing, enabling regulations of mortgage and property ownership, focus on sustainability, entertainment, environment, tourism, high to mid-end retail and commercial public space have had a significant impact. According to a recent study by Mordor Intelligence, the real estate market size in KSA is expected to grow from USD 64.43 billion in 2023 to USD 94.19 billion by 2028, at a CAGR of 7.89% during the forecast period.

This kind of uplift in real estate and construction activities has placed an increased demand for debt-based funding compulsions for which the predominant source remains the local bank market. Banks represent majority of the lending activity in the real estate loan market. As per recent SAMA estimate banks’ lending in 2022 represented approximately 96.3% of total outstanding real estate loans with the remaining 3.7% being advanced by finance companies. There are other incremental funding avenues within the realms of local capital markets (e.g., Sukuk), the distribution for which is still anchored in the local bank market. However, the market for private real estate funds (institutional investors & high net worth individuals/family) and publicly listed Real Estate Investment Trusts (REITS) is also considerable and growing.

The focus of this article is on substantive aspects of real estate financing and structuring considerations in the local bank market.

Financing Considerations

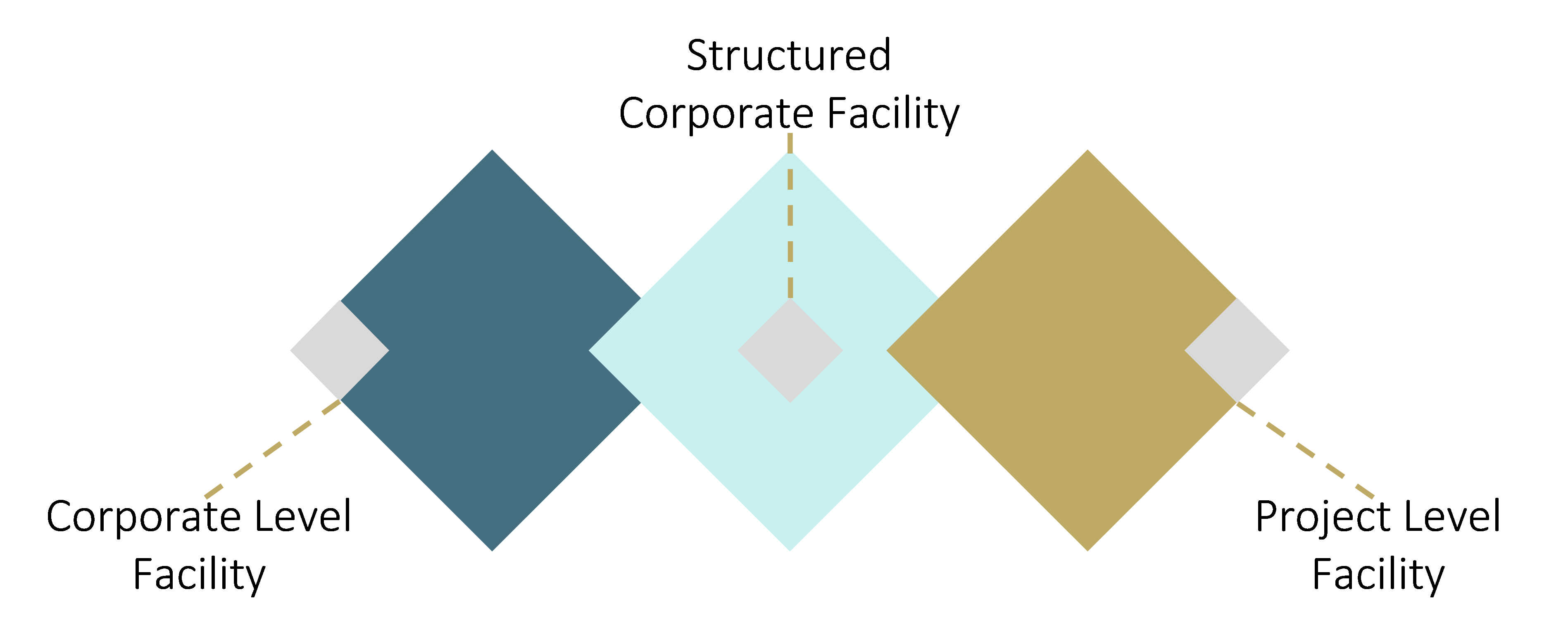

Real estate development projects often represent substantial investments with inherent risks and complexities. To ensure their viability and mitigate associated challenges, several key financing considerations must be addressed. The financing and structuring considerations are largely dependent on the type of financing raised. We outline below two important formats that are widely used in local bank market along with a focus on hybrid structure which is a combination of both. However, structured corporate facility remains within the legal ambit and framework of a corporate style facility.

In the interest of brevity, we have divided the article in two parts. In this article which is the first of two-part series, we attempt to discuss the salient features and nuances of structured corporate facility. The second part will be a sequel publication focusing on a project finance style facility.

Corporate Level (or Corporate Style) & Structured Facility

Typically, the developers can raise financing at their corporate level on the basis of their existing balance sheet, operating history, and long-term corporate strategy. This format of borrowing is suitable for developers that are straddling between expansion and high growth trajectory across the length of their corporate life cycle. During this stage they have a successful history of execution and economically viable projects in hand that are expected to deliver investment returns (often measured by project Internal Rate of Return (IRR)) well in excess of the corporate hurdle rate. This hurdle rate is typically an assessment of cost of capital incorporating both equity and debt mix in line with their relevant risk adjusted measures.

The credit assessment is predicated on overall corporate credit of the company, though the project related information is also critical from a structuring viewpoint. However, unlike standard project finance, financiers will have complete recourse and full look through to the overall corporate credit of the company regardless of the potential risks and economic volatility underpinning a specific project for which the funds are being raised. Also, unlike project finance which typically requires creation of a separate project company with a specific singular project focus, a corporate level financing can provide flexibility of overall corporate purpose and application (i.e., standby medium to long term loan facility line, war chest finance) in anticipation of future projects for which accurate details may not be available at the time of concluding a financing transaction.

The purpose of facility is important to financiers as they like to see and follow the trail of their money, which is to fund the development of a certain project with a tight drawdown structure that is often ringfenced and controlled (i.e., direct payments to landowners or the subcontractors for land acquisition and construction respectively). The tenor of the longer-term financing and repayment are often structured in accordance with the characteristics, cash flow and debt capacity of the project. Hence, despite being a corporate level debt, financiers do assume a degree of project risk depending on the repayment profile and its linkages to project-based cash flows. Therefore, it is common for them to seek project specific collaterals, additional guarantees, payments undertaking and debt covenants to mitigate their credit and refinancing risk.

This type of corporate loan when linked and structured around the project acquires some features of project finance but in terms of legal recourse remain within the ambit of corporate finance. For such format, the financiers do a more in-depth credit analysis at the corporate level, however at the same time introduce structuring stratagems in the facility to minimize their specific structural risks.

We have segregated the funding considerations below according to the financing structure and corporate credit assessment:

Financing Structure

Following constitute some of the core structuring considerations from lenders’ perspective:

Legal Capacity of Borrower

This is the determination that the obligor or the borrower has legal capacity to enter into financing agreements and create indebtedness. The financing agreements legally bind the borrowers in fulfilling the agreed terms of financing along with any other obligations in relation to the collaterals, corporate or personal guarantees perfected as a part of a standalone or integrated security document.

Enforceability of financing and security documents

The local law opinion on enforceability and a particular choice of jurisdiction for dispute settlement are also important considerations. The financing and security agreements for the type of transaction that is being discussed are typically governed by KSA laws. However, if the contemplated financing is larger scale, USD based and has regional and international banks’ involvement, English law may be a preferred choice for jurisdiction and litigation matters.

Security Perfection.

Security perfection is an important precondition to financing. Land represents a key component of the security package for real estate financing and requires legal perfection in terms of clean electronic title deeds and registration with local authorities [i.e., Ministry of Justice]. Lenders typically require additional security including such as rental and cash flow assignment from existing properties of the company and other forms of parental/sponsor support in the form of personal and corporate guarantees.

Drawdown and Repayment Structure

The drawdown for real estate financing is typically watertight around the actual funding cash outlay of the project. There are typically clauses that govern the drawdown of financing to ensure a fair and proper trail of the borrowed money such as directly to seller of the land or subcontractors for various stages of construction. The repayment is also inextricably linked to project related cash inflows, however, unlike project finance the lenders have full recourse to the wider pool of corporate cashflows in adverse situations. Therefore, the principal grace period and repayment profile (e.g., balloon, front-end or back-end, equal amortization etc.) are sculpted to reflect the economics of the project.

Financial Covenants

In addition to collateral and security measures, lenders impose stringent financial covenants to mitigate risks associated with real estate linked financing. These covenants serve to regulate the financial standing of the project throughout its lifecycle and ensure timely debt servicing. Common financial covenants at corporate level include maximum leverage (Debt-to-Equity (D/E) ratio, minimum tangible Net Worth, and minimum/average Debt Service Coverage Ratio (DSCR). These may be supplemented by project focused covenant such as maximum loan-to-cost (LTC) or financing Debt to Equity ratio and other specific details of the project. Compliance to these covenants is integral to maintaining lender confidence and securing continued bank commitment for the project.

Corporate Credit Risk

Following constitute some of the key corporate credit considerations from lenders’ perspective:

Quality of financial reporting

This is a statutory requirement of Ministry of Commerce and remains a core focus of creditors in terms of assessing economic reality of company’s performance during the reporting period. The independence and market reputation of auditors along with compliance with local and global accounting standards are also crucial factors in this assessment.

Shareholders profile and legal structure

Shareholder or sponsor’s profile and legal structure are critical for financiers for multiple reasons in developing internal credit risk appetite for a particular name. It is important to establish who exactly the financiers are dealing with as their credit counterparty, essentially to determine the kind of implicit or explicit parental support that emanates out of a particular corporate structure. Is the ownership rooted in family, private corporate and institutional investment, government, sovereign linked, or corporate cross shareholdings? Whether the legal structure of company is of holding investment or operating in nature? Is it a Joint Stock Company or Limited Liability Company? Is it held privately or listed on Tadawul? These are some of the key considerations that have bearing on the outcome of a financing discussion at the corporate level.

Staying Power

A related point to the shareholder profile and legal structure is the staying power in the market as a corollary of the ownership reputation and their legal standing. More from property or infrastructure development perspective, it is critical to assess the sponsors profile and reputation in the market in terms of long-term staying power, their ownership of the land bank and properties. The involvement of public sector in any form of government linkages usually support and elevate the staying power. Likewise, powerful private shareholding of recognizable and dominant family groups improves the strategic outlook of the company in terms of long-term staying power.

Management Quality, Risk & Corporate governance

In real estate industry, the quality of management can be readily gauged by evaluating successful execution and timely delivery of announced projects to its end users. These projects make news headlines and are at times sold to customer on an off-plan basis. They are visible in terms of creating reputation and brand space for the company. The success story that the bank market looks for is often built over many years by experienced management with solid history across all areas of operations, and execution of large, long-term, and complex projects. Sound risk and robust corporate governance practices are relevant credit-based considerations across the entire spectrum of corporate finance and are not industry specific. The independence of Board in regulating the management, financial controls, transparent oversight, and risk management reduce the risk of corporate failures industrywide.

Scale & Size

The scale of a company in terms of its overall revenue size and its core sustainable operating income generating ability is crucial in credit assessment. Many banks locally have their corporate coverage team segmented by the size of the relationship company in terms of their revenue base. Larger companies operate from vantage point with respect to ownership and access to prime lands, unique locations, best labor workforce and subcontractors, regulatory ease, and dispensations, which can all set them apart from their smaller competition. Large public, private or sovereign linked companies also tend to have greater access to the local, regional, and international bank and debt capital markets.

Market Positioning & Diversification

The significance of strategic market positioning and diversification for real estate companies could not be underestimated from a credit viewpoint. Strong market positions insulate companies from economic cycle, offer competitive strength and visibility and reduce reliance on a particular subcontractor, building material and labor workforce provider. Diversification can be across a) key geographic markets (local – cities/provinces, regional, and international), b) sectors (retail, commercial, office, hospitality, healthcare, logistics and storage etc.), c) property types (high-rise, villas, malls, communities etc.) and d) customer segments (high-end luxury, mid/low budget etc.) Diversification helps maintain operational stability and profitability despite sector specific market fluctuations and industry challenges.

Key Financial & Credit Metrics

Under all circumstances, financiers take numerate textbook credit evaluation very seriously and each bank has their own risk parameter and lens through which they see and assess a particular credit. Evaluating a company’s creditworthiness hinges on factors like profitability, operating efficiency, leverage, and financial adaptability. Sound profit generating ability is an important sign because it is reflective of sustainable cash flow for servicing the debt and maintaining an adequate debt coverage. The latter is often measured in terms of Debt Service Coverage Ratio (DSCR). Creditors typically like to see sustainable history of profitability (three years and more) or justifiable rationale and mitigants for adverse deviations thereof.