KSA Real Estate Financing Considerations (Part 2)

In Part 1 of this article, we outlined the spectrum of financing options available for real estate projects. We attempted to deliberate on specific structural and corporate credit imperatives around a corporate-level facility. In this sequel, we shall discuss important considerations for project financing that are widely done on a limited recourse basis to project sponsors. Theoretically, it can also be structured on a fully recourse or non-recourse basis. There is also local and regional debt capital market precedence for project sukuk/bond. However, the focus of this article is on limited recourse bank-based project financing.

The ever-changing project financing landscape is affected by multiple factors, such as lending capacity and sectoral constraints of financiers, local operating environment, and interest rate volatility. Environmental, Social, and Governance (ESG) considerations make sponsors’ input earlier in the process critical for enhancing a project’s bankability and success.

Project Level Facility: Limited Recourse Basis

A project financing is typically a limited recourse transaction (to sponsors), longer tenor in nature (seven years+ plus) in which the focus is on creating a secure source of revenue from the project to be constructed to fund operating costs, service debt and ultimately deliver an equity based Internal Rate of Return (IRR) to sponsors.

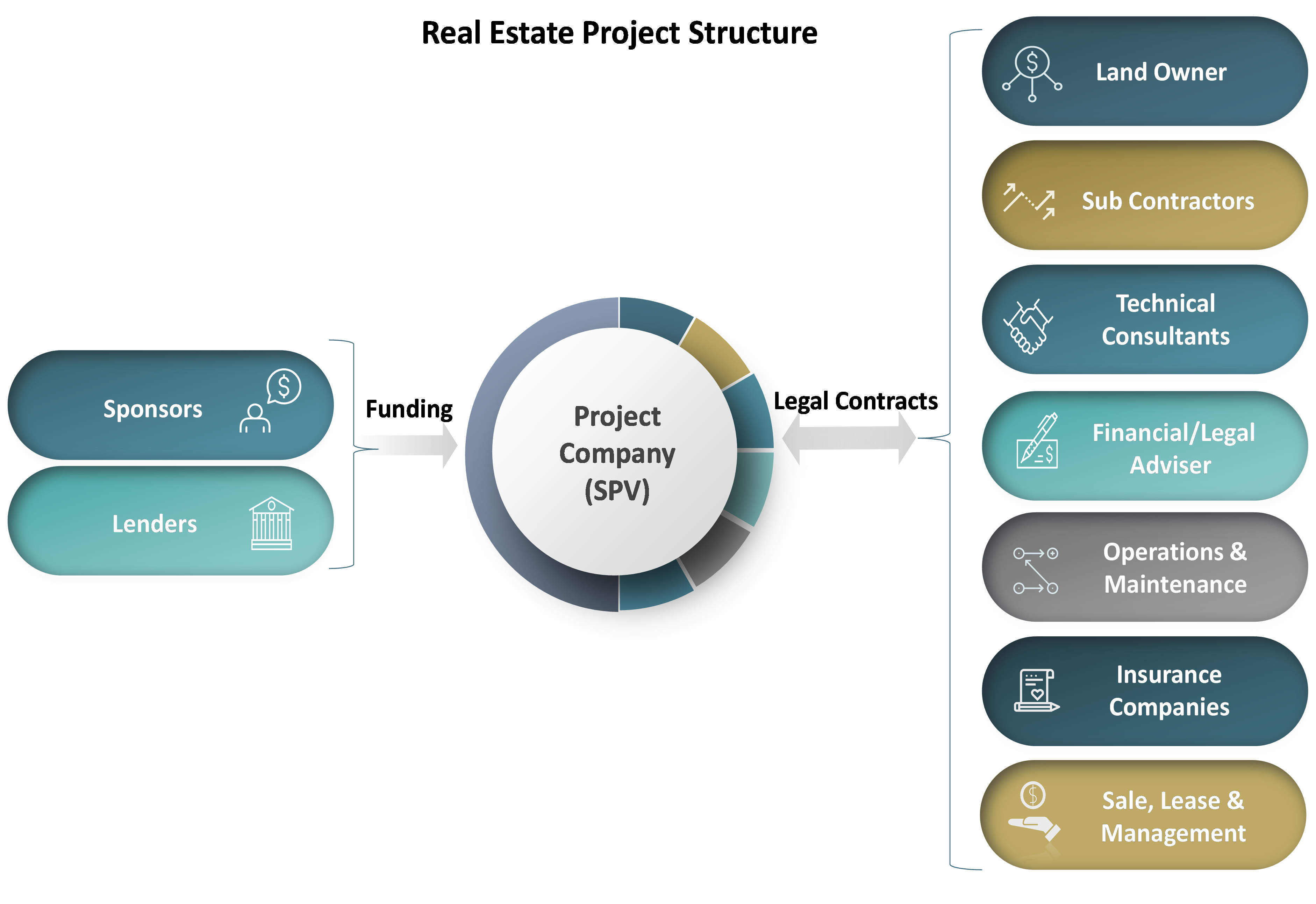

This type of financing is central to the project in focus and is often done through a distinct project company (Special Purpose Vehicle (SPV)), especially incorporated for the purpose of owning and managing the project assets. Therefore, the credit counterparty for financiers is the project company (SPV) and not directly the sponsors of the project. However, this type of facility can still have limited recourse to the sponsors, the degree of which hinges on the agreed terms and conditions of the underlying financing and security documents. Regardless, the economic viability and long-term cash flows of the project remain the core focus and repayment source for lenders. Limited recourse to the sponsors is crystallized in distinct phases of the project and under specific eventualities. This is more of a financing imperative during the earlier construction phases, wherein the positive project cash flows have not yet commenced and stabilized.

Typical Real Estate Project Structure

In large commercial banks locally, within corporate coverage, there is a separate product/sector specialist group dealing with project financing. Depending on complexity and scale, project financing can involve a club or syndicate of banks to distribute the overall debt component and exposure. Depending on the creditworthiness of the project and sponsors, the equity component may also be deferred and funded by a relatively shorter-term debt (five years-minus), often referred to as Equity Bride Loan (EBL).

Technical consultants and independent legal & financial advisers may also assist the sponsors with coordinating key project milestones and leading the overall financing, documentation, and arrangement process. The figure below outlines important contractual relationships for a real estate project.

We outline below some of the key risks that banks pay close attention to when evaluating project finance risk from a real estate perspective:

- Construction & Completion Risk (i.e., delays, cost overruns, etc.)

- Market Risk

- Sale, Income generating Lease & Management Risk

- Legal & Regulatory Risk

- Cash Flow Risk (i.e., Debt Service Coverage during the life of the loan and project)

- Political & Force Majeure Risk

- Environmental, Social & Governance (ESG) Risk

Banks need various risk mitigations or credit enhancements in the context of risks enumerated afore that could potentially raise the total cost of the project (i.e., insurance/bank guarantees/sponsors’ Debt Service Undertaking (DSU)) or alter the risk profile of the underlying financing structure.

Key Project Financing Considerations

Project Viability

Success in securing debt financing for such projects depends primarily on the economics of the project itself. Lenders scrutinize the project financial model, analyzing income and cost structures, wherein their repayment is tied directly to core operating income. Therefore, developers must meticulously evaluate the cash flow generating potential of the project to reassure lenders of its profitability and repayment capacity. Typically, a complete bankable financial model is required by the financiers that is underpinned by sound and realistic input assumptions. Various sensitivity and stress scenarios are run to gauge the robustness of the financial model provided by the sponsors.

Capital Structure

Typically, the Debt: Equity structure of a successful project is within the range of (Debt 70-80%: Equity 30-20%), depending on multiple factors, debt capacity of the project being one of the most important to consider from lenders’ perspective. The reliability of the project’s revenue is heavily dependent upon the delicate balance between the project’s commercial viability and legal certainty of the risk allocation in the context of an optimal mix of debt and equity financing to fund the project.

Explicit and Implicit Credit Support

Long-term project viability often relies on sponsors’ explicit and implicit credit backing. Explicit credit support can be in the form of a Stabilization Guarantee & DSU during the construction period or a Completion Guarantee Support by sponsors. These credit enhancements typically come in the form of additional funding commitments or guarantees from sponsors to address any cost overruns, delays, or unexpected challenges that may arise during the initial phases of the project. Implicit support can be in the form of financial commitment, operational expertise, reputation, assurances, and informal guarantees. The credit spread on the loan is intrinsically linked to explicit and implicit credit support and the risk profile of the project, further underscored by the extent of hard project collateral that is discussed below.

Perfection of Collaterals & Other Security Measures

Typically constituting a sizable portion of the initial capital costs, the value of the land sets the foundation for the project’s success. This underscores the criticality of thorough land valuation and legal assessment of clean title etc., prior to embarking on any debt financing exercise. Land bank often constitute as a fundamental component of the security package in real estate financing and requires legal perfection in terms of clean electronic title deeds and registration. Financiers normally require a higher collateral coverage beyond 100% of their financing depending on multiple credit-related factors, the most important of which is the realizable value of collateral upon liquidation.

Lenders also require additional security measures such as assignment of project income, sale and income generating contracts (sale/lease), project accounts, insurances etc. Furthermore, the establishment of a Debt Service Reserve Account (DSRA) is often a structuring requirement that provides an additional layer of security for debt servicing. In addition, lenders impose restrictive financial covenants to mitigate their risks such as maximum Debt-to-Equity (D/E), Loan to Cost/Value (LTC/LTV), minimum Debt Service Coverage Ratios (DSCR) and Dividend restriction DSCR.

Sale & Income Generating Contracts

Securing creditworthy counterparties for the end-use and purpose of projects earlier in the process enhances the commercial viability of the project. This could be anchor sale and lease contracts and management and operator agreements depending on the type of property, segment, and development. Off-plan sales are common for residential projects and pre-leasing for long-term income-generating residential, retail commercial, office, and mixed-use projects. Hospitality segment projects are often secured by a Hotel Management Agreement or Franchise Operators Agreement with reputable industry brands and operators. These contractual arrangements provide stability and certainty of project revenue streams, hence improving the overall credit and investor confidence in the project.

ESG Risk Integration & Islamic Finance

In recent times, real estate projects, similar to infrastructure projects, have also been driven by ESG and Shariah compliance concerns that are integrated earlier into the project due diligence stage, with implications for financing considerations. Financiers are regulated and compelled by local and international organizations that place special emphasis on promoting environmentally and socially responsible projects.

The Islamic finance market in KSA has grown in depth and capacity due to the regulatory impetus, sophistication of Islamic financiers and strong demand both at retail and institutional levels across public and private sectors. Sustainable financing options, such as for green, socially beneficial, and ethical projects, along with a local emphasis on the Islamic format of financing, provide broader avenues and the most inclusive pool of liquidity for raising capital.

In conclusion, the financial viability of a real estate development project relies on a multifaceted approach that encompasses intensive project management and multiparty engagements well ahead of the requisite financial close timeline.