The Road to Hedge Accounting

Earlier last month, the world witnessed one of the largest bank runs in history when depositors of Silicon Valley Bank (SVB) withdrew $ 42 billion (~25% of deposits) in one day. The bank run was ignited by the news that it was trying to raise capital to compensate for a $ 1.8 billion loss caused by the sale of Available for Sale (AFS) government securities.

Investment securities can be reported in a bank’s balance sheet under two categories, AFS securities or Held to Maturity (HTM). AFS securities are measured at fair value, marked to market (MtM) at each reporting period, and gains/losses are captured in the financials. HTM securities, on the other hand, are held at book value and are measured based on their amortized cost. When rates started to increase, no MtM adjustments were reflected, nor were any losses felt for those HTM securities that represented around 76% of SVB’s investment securities as of Dec.31st, 2022. This raises the importance of understanding how financial securities are recorded and how their unrealized gains and losses are recognized.

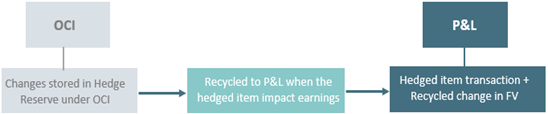

In the case of a derivative contract, gains/losses have to be reported on P&L. Yet, by applying hedge accounting, an entity can store the changes in derivatives’ fair value in the Other Comprehensive Income (OCI). The primary purpose of hedge accounting is to reflect an entity’s risk management activities in its financials, and by doing so, it significantly reduces earnings volatility. Even though it is optional to apply, many businesses elect to apply hedge accounting to establish an alignment between their economic objectives and the financial reporting of their derivatives transactions.

The implementation of hedge accounting has to comply with the IFRS9, and as per the standard, there are three types of hedge accounting: Fair Value Hedge, Net Investment Hedge, and the Cash Flow Hedge. The latter represents the most common type among these types and is the focus of our discussion in this bulletin.

So, by applying the concept of hedge accounting, a derivative contract would be designated as a hedging instrument that matches a hedged item (e.g., a floating loan) in all its critical terms, except that its fair value moves in the opposite direction to the hedged item. Adding to that, gains/losses on the derivative (hedging instrument) are recognized in the OCI to be recycled later to P&L. At the same time, the hedged item transaction impacts earnings, achieving an offsetting relationship that can mitigate P&L volatility.

WHERE TO START?

A decision of whether to apply hedge accounting or not should be considered by an entity before entering into a derivative agreement. Once a company approves the market risk management strategy, and before starting negotiations with a hedge provider, think carefully about the type of the financial derivative and its embedded features.

Starting with the product choice, plain-vanilla instruments are usually compatible with hedge accounting requirements, and hence, an entity’s task would be much easier with that understanding in mind. Among those, the most common are interest rate swaps, representing around 86.5% of the $ 5.2 trillion total global daily turnover of the Over-the-Counter (OTC) interest rate derivatives markets, as per the latest triennial central bank survey published by the Bank of International Settlements (BIS) in 2022. Another instrument is the interest rate cap/floor, an option-based derivative with a hedge accounting treatment that is slightly more complex than swaps. This additional complexity is mainly attributed to the need to quantify the contract’s optionality aspects and properly account for the nonlinearity of these instruments. For FX risk management, on the other hand, the popular outright forward and plain-vanilla option contracts are hedge accounting friendly products that can effectively mitigate FX volatility.

So, choosing to apply hedge accounting is optional. Yet, once an entity elects to apply it, it must adhere to the relevant IFRS standard (IFRS9).

COMPLY WITH THE STANDARD

For a hedging relationship to be deemed effective in accordance with the IFRS9, some qualitative factors must adhere to the standard requirement.

Economic relationship exists

There should be an expectation that the fair value of the hedging instrument and hedged item would move in opposite directions, resulting in an off-setting relationship that reduces the risk. For such a relation to exist, critical terms such as notionals, tenors and underlying exposure between the hedging instrument and the hedged item should match.

As we are approaching the end of LIBOR, the index transition represents a current threat to the existence of such a relationship. However, the International Accounting Standards Board (IASB) has provided relief for entities with legacy contracts, where derivative contract critical terms (i.e., the reference rate) could be amended without triggering a de-designation event.

Credit risk does not “dominate” value changes

As per the standard, the risk that either party to a derivative contract may fail to satisfy their obligation has to be quantified. One way to do this is via computing the Bilateral Credit Valuation Adjustment (BCVA). BCVA is only common for OTC derivatives, where counterparty credit risk is present, unlike exchange-traded derivatives.

Worth mentioning, IFRS did not define the term “dominant”. Yet, the change in the derivative fair value should not be mainly attributed to the credit risk adjustment. Rather, the movement should be justified by market factors (i.e., interest rates, FX rates). BCVA could be material and “dominate” the fair value movement in times of distress, such as the 2007-08 Global Financial Crises or the spread of the Covid pandemic in 2020.

Designated hedge ratio is in line with the risk management strategy

As accurate reflection of risk management activities on financials is the main purpose of hedge accounting; the standard dictates having a hedge ratio aligned with the risk management policy.

THE JOURNEY THROUGH HEDGE ACCOUNTING

Let’s say an entity has entered into a derivative agreement to hedge an identified risk, chosen a hedge accounting friendly product, and satisfied the abovementioned IFRS requirements. It is now the time to start producing the hedge accounting output that is composed of a setup stage that takes place in the first reporting period of introducing hedge accounting, and an ongoing valuation for each reporting period.

A major part of the output is the ineffectiveness testing, which introduces the so-called approach, the hypothetical method. Since a hedged item (e.g., a loan) is measured at amortization cost while a derivative is measured at fair value, an identical comparison for hedge accounting purposes to conduct ineffectiveness testing is impossible. This explains why accounting practitioners came up with the hypothetical method approach, a widely accepted practice in the market though not thoroughly defined in the accounting standards.

It starts by creating a hedging instrument (hypothetical) that perfectly hedges the underlying risk. Then, the fair value movement of the hypothetical & the actual derivative is computed. Any changes in the actual derivative that deviate from the hypothetical’s, is an ineffectiveness that should be reflected on the P&L.

So, one might wonder, why would an entity bother going through all these steps to comply with an IFRS standard that is actually “optional” in the first place? As I mentioned, hedge accounting enables an entity to better represent its risk management activities in its financials. Secondly, it shakes off external factors (i.e., market risks) that impact an entity’s earnings and improves the understandability of an entity’s performance, and that’s why hedge accounting matters!