Approaching the End of LIBOR

More than a year ago, I wrote an article that shed some light on the unfolding of an extraordinary event with global financial repercussions and its local implications (Are You Prepared for a World Without LIBOR?). The LIBOR cessation project is such a massive undertaking that many have been skeptical as to whether it could really be materialized. Since then, plenty of developments have been taking place and the current landscape is one that is pretty much different than the one existed back then. This article will provide a high-level synopsis of some key milestones achieved and the current practices surrounding this project. I will focus more on the US dollar LIBOR given its greater presence and influence in the local market.

The ending of LIBOR as we know it is around the corner. Just about four months from now separates us from the official day on which this important global benchmark will no longer be published on a representative basis. What is notable here is that certain US dollar LIBOR settings will still be published post June 30th of this year, yet under a non-representative synthetic system. A synthetic US dollar LIBOR is not intended to be a perfect substitute for the original LIBOR, but rather a fair approximation of what LIBOR might have been. Its working methodology would resemble that already applied to the Sterling and Yen.

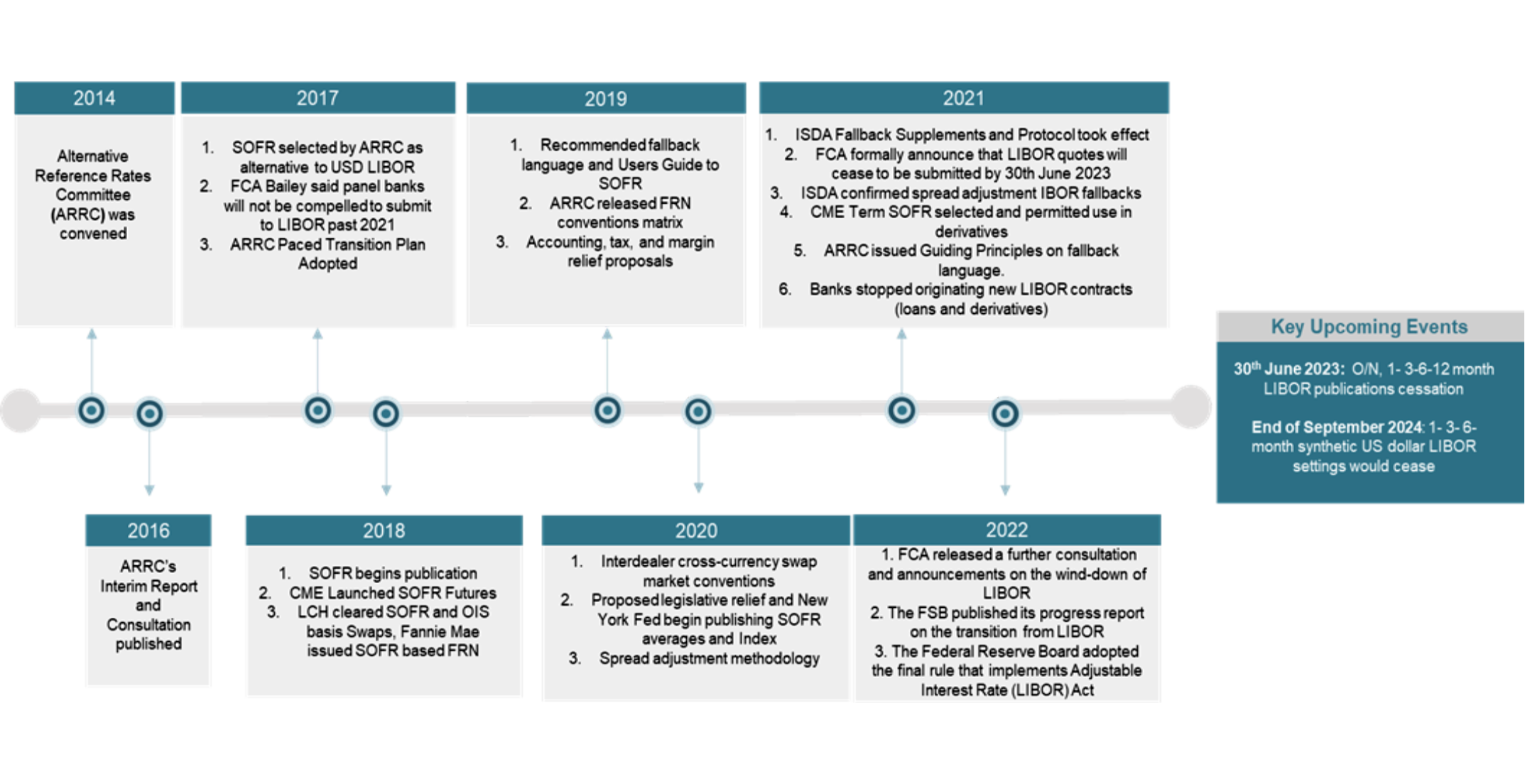

Such an approach uses a particular version of risk-free rate (RFR), for the US dollar, it will likely be Term SOFR, and add the relevant International Swaps and Derivatives Association (ISDA) calculated spread adjustment on top. It is designed as a temporary solution for tough legacy contracts and not for use in new contracts. To that end, the Financial Conduct Authority (FCA) has been explicit that the overnight and 12-month US dollar LIBOR settings will cease at June end of 2023. While it has proposed that the 1-, 3- and 6-month synthetic US dollar LIBOR settings would cease at September end of 2024. The below timeline highlights some of the key events since this mega project began.

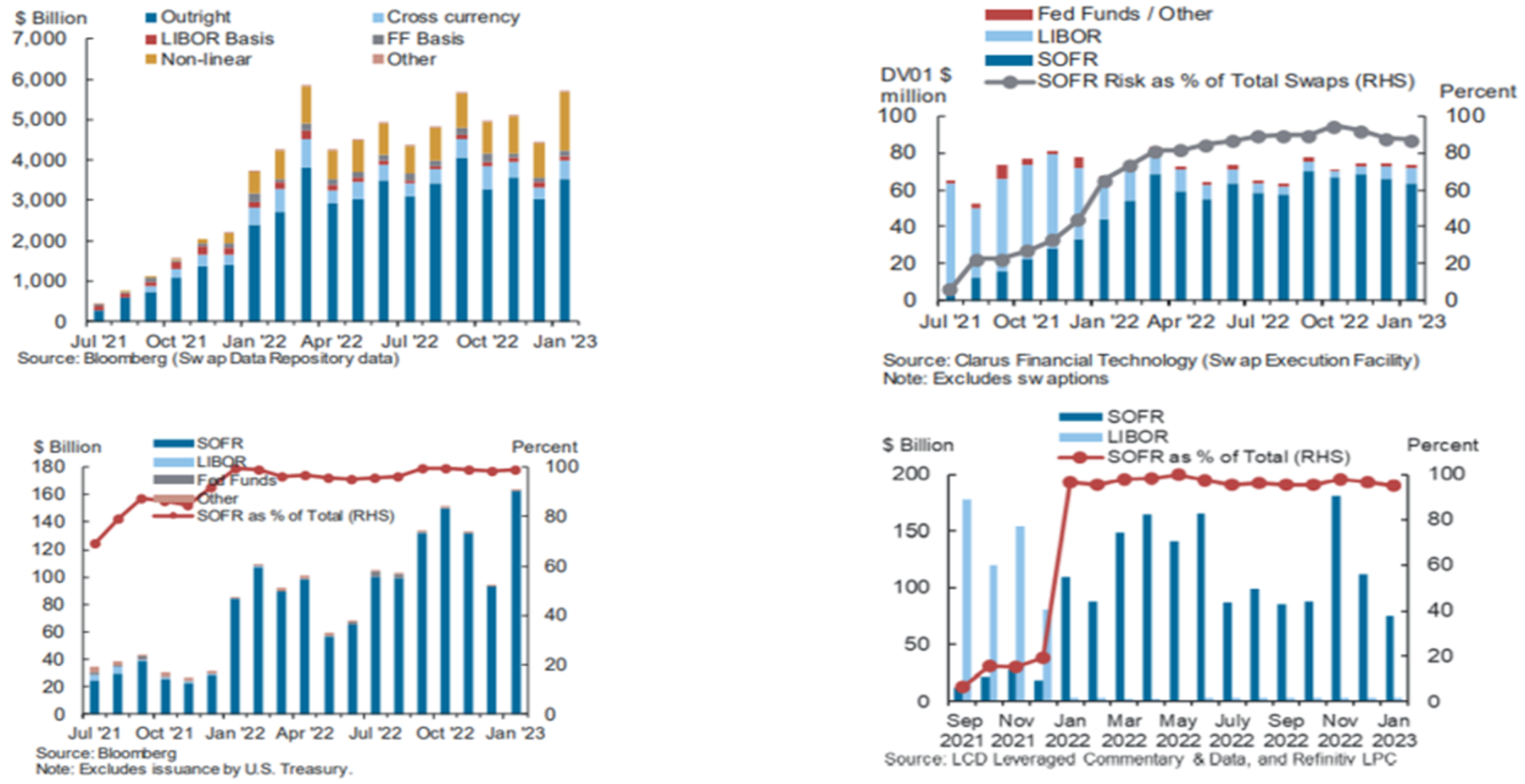

What is remarkable is the level of progress this transition has been throughout last year and the start of this year. According to the Alternative Reference Rates Committee (ARRC) February readout, SOFR interest rate swaps have accounted for more than 85% of daily volumes on average in the swaps market since June 2022. On the other hand, LIBOR swaps accounted for less than 10% of the overall volume over the same period (as shown below in the upper right figure).

Similarly, monthly SOFR OTC derivatives volumes (upper left figure) have consistently increased for the same period. As for data from the cash markets, both the issuance of floating rate notes (bottom left figure) and syndicated lending (bottom right figure) are predominantly in SOFR. This is a completely different picture from the one witnessed back in 2021. This progress to transition from LIBOR is all happening despite the heightened volatility seen recently in interest rates.

A COMMERCIAL AND CONTRACTUAL DILEMMA

Though remarkable the transition from LIBOR may seem, there are still some challenges that lie ahead. This is particularly true in the US loan leveraged market, where a considerable portion will still need to make the switch ahead of a looming deadline. Transitioning from LIBOR has been a matter of commercial and contractual ramifications.

Surprisingly, the transition of derivatives has been smoother than that of the cash market (loans & debt instruments). ISDA has begun its work to create a robust fallback language for IBOR derivatives contracts since 2016, and its widely accepted protocol has been effective since 2021. On the other hand, loans vary based on the timeframe in which they have been established.

There are loans that have been made prior to 2018 and usually lack the typical LIBOR cessation provisions. These loans would benefit from the existence of a synthetic LIBOR by June 30th as the other alternative would normally be Prime rates, which are often more expensive. Loans that came later usually include amendments with hardwired fallback languages but may or may not include a non-representative trigger to transition from LIBOR. Dealing with these types of loans can be a bit trickier.

You may have heard the term credit spread adjustment (CSA) more than once in the last two years. Further, I am sure you are aware that LIBOR is different from SOFR, in the sense, the latter is nearly a risk-free reference rate while the former embeds a credit risk component. Thus, it is a market practice to add a spread on top of SOFR to amend LIBOR based loans. This spread has been the subject of debate since this transition process started. It simply needs to be fair for lenders and borrowers alike. The ARRC, aligned with the ISDA methodology, has recommended a credit spread adjustment for cash markets in early 2021. The methodology uses a five-year historical median difference between LIBOR and SOFR which translates to the following recommended spreads for some of the most common tenors; 11.448 basis points for one-month, 26.161 basis points for three-month, and 42.826 basis points for six-month.

The CSA for loans that are without explicit LIBOR cessation provisions (i.e., are short of a benchmark transition event that is due to loss of representativeness – “”non-representatives triggers””) or newly SOFR based originated loans, becomes a point of negotiations among the parties involved. From the borrower’s perspective, it may be economically beneficial to opt for an early transition and apply the current market standard (approx. 10 basis points flat for a three-month tenor) than use the ARRC-endorsed 26 basis point or even settle for a synthetic LIBOR if applicable. A saving of 16 basis points per annum on a significant borrowing exposure should not be taken lightly. Then again, from the lender’s perspective, this may be problematic once interest rates normalize over the medium to long term.

The searchable database is filled with different CSA trends and cases. There are trends that aims to dynamically define this spread but has been operationally difficult. There have been cases with no spread adjustment incorporated at all, and the negotiations between parties just revolved around altering the financing interest margin. In addition to cases where the spread starts with a static adjustment (based on prevailing spot spread) and flip later at a certain point in time to the ARRC recommended spread. For the foregoing reasons, some may argue it has been a benchmark battle, as obviously every choice carries its own pros and cons.

UNDERSTAND YOUR OPTIONS

We have been receiving a considerable number of requests from local corporates who seek our support to transition from US dollar LIBOR prior to its cessation. Some have been acting proactively, but others are reacting in response to banks initiating the process for both affected loans and derivatives.

In these circumstances, one of the first things an entity needs to address is to understand its exposure. This entails a deep dive into multiple factors that include but are not limited to the type of loans (bilateral or syndicated), documentations (the existence of LIBOR cessation provisions and fallbacks), level of flexibility with lenders, hedging and accounting considerations (the possibility of mismatch between the hedged item and instrument).

It is crucial that the entity become aware of its available options as they transition to a risk-free rate and understand how each alternative will impact its business. An entity may passively approach this process, and in this case, current facilities’ fallback provisions will apply or proactively transition away from LIBOR. The latter approach involves validating the adequacy of banks’ proposed amendments, including those related to the CSA, to ensure they align with global practice and aligning them with the entity’s treasury management objectives.

Since each financing and derivative agreement will have to be individually amended, the implementation process can be a tricky one, and hence would requires a delicate attention to detail. What has been interesting about this transition process is the level of inconsistency between one case and the other. Across the last two years, we have seen a varying degree of flexibility, interaction, and transparency regarding the range of alternatives offered to our clients. Nonetheless, our message has been consistent and centered around the value of making an informed decision that is best suited to our clients’ objectives.