Splitting the Risk: Managing Interest Rates in Project Finance

Saudi is undergoing a growth explosion. For evidence, you need to only look at the debt market. As per the Saudi Central Bank Monthly Statistical Bulletin, Banks in the Kingdom have extended over SAR 2.2 trillion (USD 0.59 trillion) in credit facilities to the private sector until December 2022. Around half of the Banks’ credit is classified as long-term (SAR 1.2 trillion), revealing the strong momentum of Saudi’s exceptional growth story.

Core to this story are Public-Private Partnership (PPP) transactions and the wider Project Finance industry. Both are accelerating rapidly, supported by the government’s prioritization of infrastructure projects, along with mega and giga projects across the Kingdom.

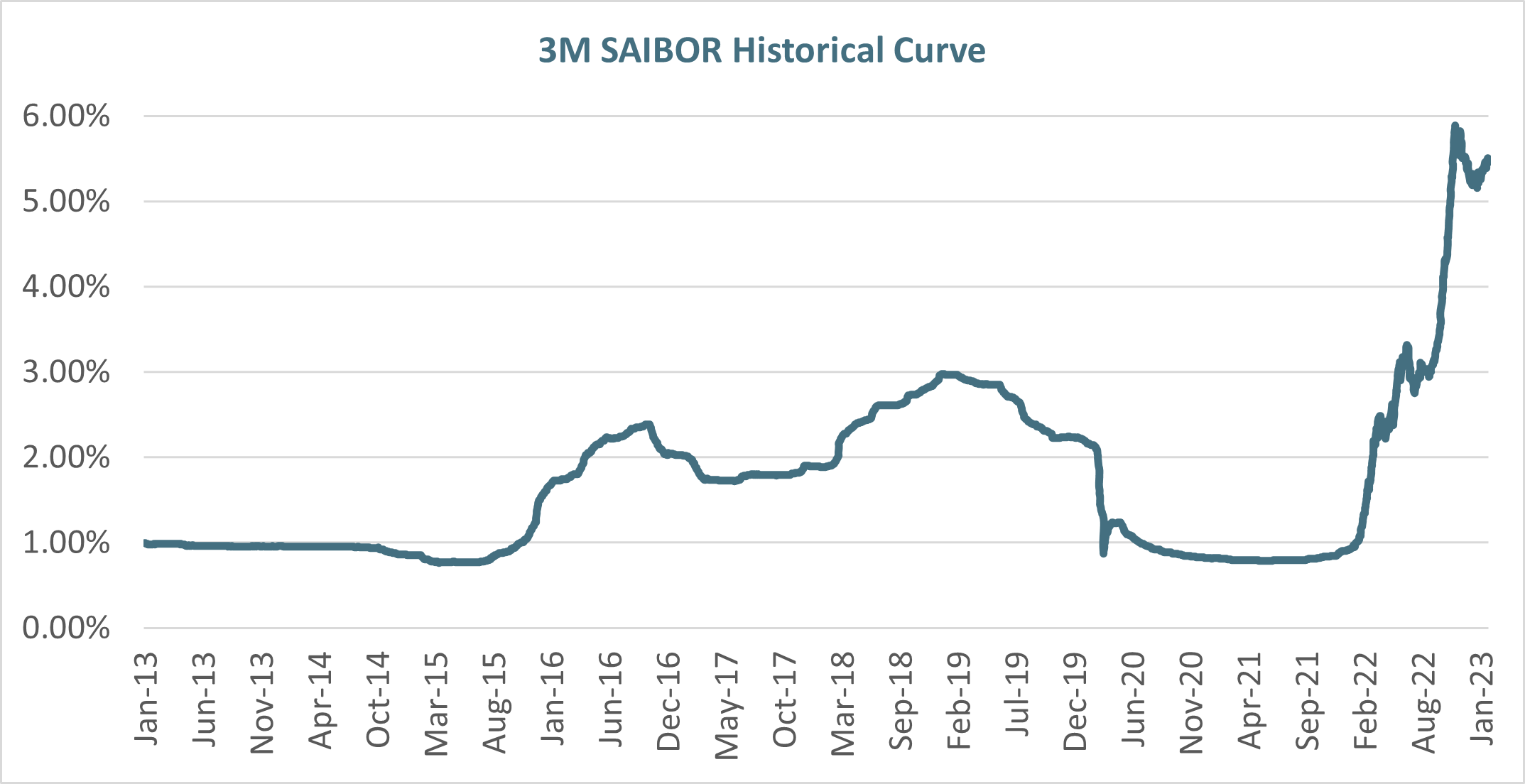

Yet this remarkable expansion comes with risks, one of which is interest rates. They have surged recently and grown highly volatile – look at the movements of the 3-Month Saudi Riyal Interbank Offer Rate (SAIBOR) in the last decade. Compared with just 0.52% for the first five years, the daily standard deviation has more than doubled to 1.21% for the latter five years.

The recent volatility in interest rates throws up questions about the risk allocation between two primary stakeholders in any project finance transaction. These stakeholders are first the project company, a special purpose entity created to deliver the project, and which has the project as its only asset. The second stakeholder is the project’s beneficiary entity, which pays the project company to deliver the agreed scope (we will call this entity the off-taker, and we can also call it the procurer).

Given the recent surge and volatility in interest rates, what are the primary considerations regarding splitting the risk?

Local Market Brief

The allocation of interest rate risk differs per project. However, the typical approach in the local market puts the burden on the off-takers. They assume the risk of interest rate movement as reflected in the winning bidder’s initial financial model until the hedge execution date. In this case, the bidder’s profitability remains intact and protected from any interest rate impact until the hedge execution.

For example, if the interest rate rises above the assumed rate at the execution date, the financial model would be adjusted to keep the profitability metrics intact, and the off-taker would pay for the interest rate deviation. However, if the interest rate falls, the off-taker benefits.

Managing this risk requires an optimal hedging strategy and an understanding between the stakeholders of the risk allocation from the outset. Therefore, let us examine this process in chronological order.

Before Submitting the Bid

The project company must articulate a hedging strategy, specifying critical aspects such as the hedge duration, optimal hedging quantum, and the instrument under consideration. Buy-in from the lenders and hedge providers is necessary for a smooth close-out.

The project company’s goal is to arrive successfully at the Financial Close, where it satisfies all conditions precedent to the initial availability of funds under the project financing agreements. It must therefore focus on securing the financing and executing the relevant documents as soon as possible. However, an inappropriately planned hedging strategy could cause delays and force the project company to face unfavorable economic terms.

Understanding the interest rate risk allocation before submitting the bid helps the project company establish the financial model and forecast. For instance, if the planned financing is long-term and the financing currency is not liquid enough for the whole hedge tenor, it is essential to quantify the potential impact and build it into the project economics. It must be clear at the beginning whether the off-taker continues compensating the project company for the interest rate risk after hedge execution (the unhedged portion). If the off-taker participates in the subsequent gains but not the losses, the project company should assess this irregularity.

Typically, any margin made by the hedge providers is excluded from the off-taker compensation plan, as the project company bears the cost. For this reason, planning and discussing the hedging credit spread with the hedge providers early in the process is crucial.

After Winning the Bid and Before the Financial Close

This point is the backbone of the whole process, and its success depends on how well the project company formed an understanding of the agreement in the preceding step.

The project company might prefer all relevant parties to agree on a hedge credit spread. Some prefer the spread to be uniform across the lenders or hedge providers. But it is also acceptable and sometimes advisable to have discriminating credit spread according to risks carried by the lenders.

We have also seen a completely different approach, where the project company pushes for credit spread competition among the hedge providers. In that case, every lender has a right to match according to the debt size on a prorated basis. The downside of this approach is that a lender might lose the opportunity to participate in an income-generating trade, impacting the initially assumed profitability of the transactions.

If there is a minimum mandatory hedging requirement for long-term financing, the project company could obtain a tighter credit spread for the subsequent tranches. However, such a spread could be better than the first tranche due to the lower risk during the project completion or operation periods. Failing to open a dialogue at the beginning means the project company accepts–by default–the initial credit spread for the following hedges!

I cannot stress enough the significance of drafting a Hedging Protocol early. The protocol must align perfectly with the agreed hedging strategy supported by buy-in from all stakeholders. Typically, the party who assumes the interest rate risk has more flexibility to design the protocol to ensure fairness, prudence, and transparency when covering the interest rate risk.

A dry run (rehearsal) of the hedge is an excellent way to test the protocol’s reliability from a process perspective. However, an independent benchmarker should be present (highly advisable) to validate the lowest competitive rate–the lowest rate is not always the best!

Given the complexity of the financial modeling involved in project finance transactions, the cashflow changes according to the hedge rate. Therefore, coordinating timely turnarounds with the updated cashflow is crucial. The financial/hedge advisor must administer the process according to the Hedging Protocol’s definition of it. Some project companies and off-takers are inclined to put an acceptable deviation limit between the assumed floating curve and the actual market rates. However, each party must understand the magnitude of such an impact and set appropriate thresholds.

The ISDA (International Swaps and Derivatives Association) Agreement and its schedule specify the terms of the derivative dealings. The ISDA schedule is customized and negotiated commercially and legally. The hedge advisor’s role is to cover the commercial aspects and ensure they are rational, coherent, and reasonable. This becomes more significant for long-dated hedges, where interest rates are subject to conversion to alternative floating rates in the future. The project company must approach this process cautiously and negotiate any language to fully comprehends the implications. Again, this document should be among the first to be finalized during this step.

During Hedge Execution

After a satisfactory dry run and completion of all documentation, the big day is due: the hedge execution. At this point, the project company has a clear view of the economic terms and hedge details.

To avoid last-minute surprises, perform a sanity check of the indicative hedge term sheets from the hedge providers. That will reveal any misalignment before executing the hedge. Equally important is that the stakeholders discuss the optimal execution methodology dictated by the envisioned hedge size, currency, duration, etc.

Given the live hedge quotation’s sensitivity and market forces, the hedge advisor must ensure perfect alignment among all stakeholders to avoid slippage costs and excessive hedge execution charges. All hedge providers are brought onto one call to quote discreetly; each party offers the best swap rate. If the off-taker bears the interest rate risk (where rates have increased from the initial financial model), it is in their interest to validate the fairness and reasonableness of the best rate swiftly. Remember, the lowest offered rate is not always the best.

Post Hedge Execution

If an unhedged portion of long-term debt remains after executing the hedge, the project company should manage the plan for future hedging carefully, keeping in mind the interest rate risk allocation.

We have seen cases where additional hedges are only permitted during a narrow timeframe before the initial hedge expires. This could harm the project company if it holds the interest rate risk, so we believe it should have complete discretion over when to hedge the remaining debt portions according to its risk appetite, the hedging strategy, and the project covenants.

Some project companies factor in the accounting impact of the derivative instruments. Therefore, we have seen it become increasingly popular to apply the voluntary IFRS9 hedge accounting standard to shield the P&L from potential volatility.

Conclusion

Planning an optimal hedging strategy for the project company and off-taker is a delicate process. The key to success is ensuring mutual understanding early. Using a checklist could serve the project company well during planning, prompting them to consider every interrelated factor of the hedge.

Of course, every project has particular and unique qualities. Therefore, avoid blindly applying previous hedging strategies to the present transaction. Slight differences between projects can cause vast variations in the hedging strategy and protocol.

Finally, setting expectations and responsibilities for stakeholders at the start of every project avoids overlapping tasks and ensures a smooth and seamless hedging process.