Have Interest Rates Peaked Yet?

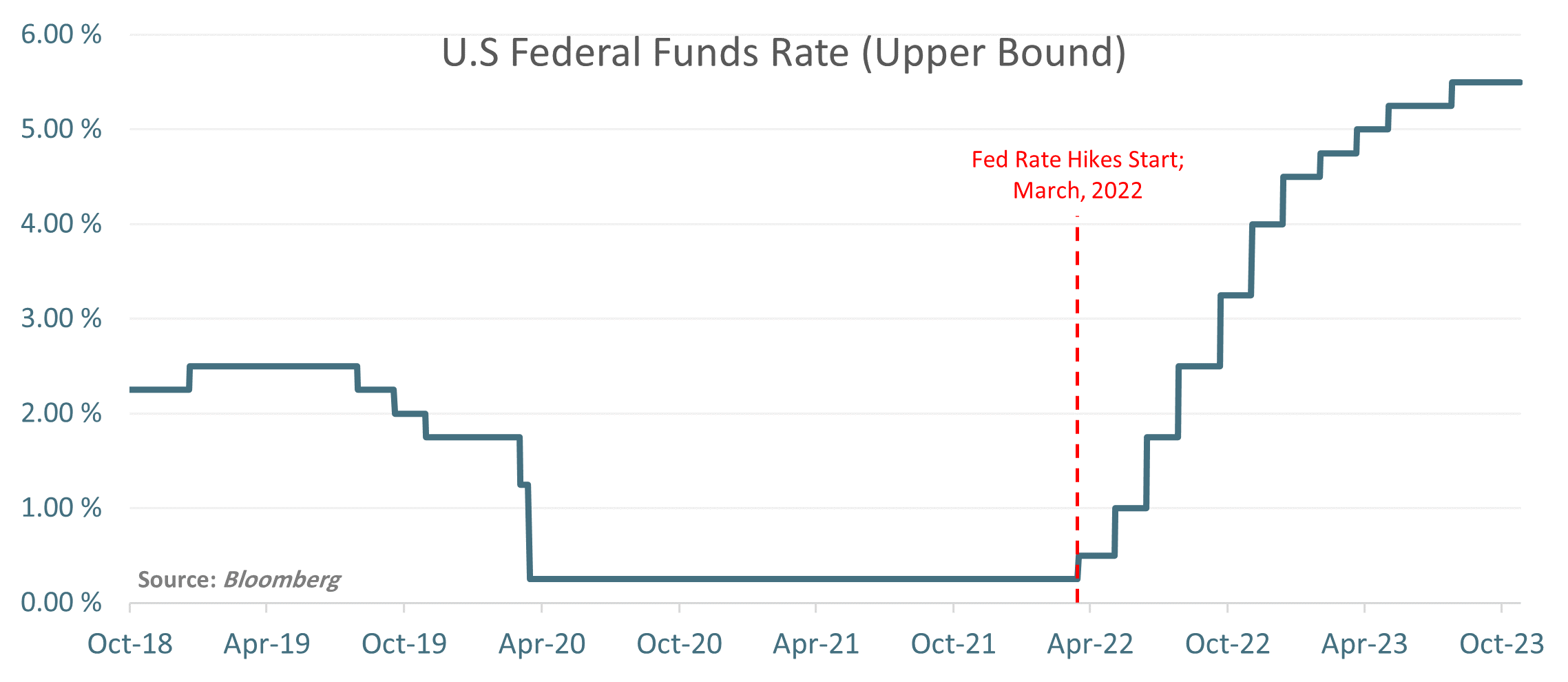

Rising interest rates have been the dominant theme since early 2022, which is when the Federal Reserve embarked on its journey to combat decades-high inflation. Starting March 2022, the Fed has hiked rates 11 times, bringing its benchmark Fed Funds rate from near zero to 5.50% (Upper Bound) by July 2023. This aggressive pace by the Federal Reserve has not been observed since the 1980’s.

In March 2020, to guard the U.S economy from the impact of the COVID pandemic, the Fed cut its benchmark Fed Funds rate to the range 0%-0.25% and initiated a massive quantitative easing program. Rates were then maintained at these levels for the next two years, i.e. until the recent series of hikes began. The consensus among investors and economists at the time pointed to rates remaining low indefinitely. Low rates assisted governments by making their sovereign debt more sustainable, while also enabling growth and profitability in the private sector. Now with rates rising steeply, firms are seeking the answer to the question – have the rates peaked yet?

While at the last Fed meeting in September the officials decided to leave the rate at 5.50% for the time being, the Federal Reserve Chairman, Jerome Powell, has not yet signaled an end to the cycle of raising rates. The common view among economists indicates another 25-basis point hike before the end of the year. It is worth noting that the benchmark rate is already at levels not observed since before the 2008 financial crisis, and a further 0.25% increase would bring the benchmark rate to a range of 5.50%-5.75%, a 22-year high.

In addition to the level of the elevated rates, focus is also moving toward the duration of the cycle, i.e. how long will rates remain elevated. The Fed requires rates to remain high until they win their fight against inflation, which they now signal may last until 2026. But the Fed also monitors indicators such as the strength of the economy and job growth status to regulate their policy. Recently, Powell stated that with a solid economy and strong job growth, the Central Bank can be enabled to focus on creating the financial conditions through 2025, with a calculated cost to the economy and labor market, required in the U.S inflation battle.

Central banks from other western nations are also offering similar indications. Both the Bank of England (BoE) and the European Central Bank (ECB) have stated that they may raise rates further if required, and that rates would remain high for a sufficiently long duration.

Thus, the message presented by the Central Banks indicates that the era of “cheap” money, i.e. easy access to funds with minimal financing costs is at an end, and markets are now absorbing the understanding that the era of “higher-for-longer” interest rates has begun.

Impact on Bond Markets

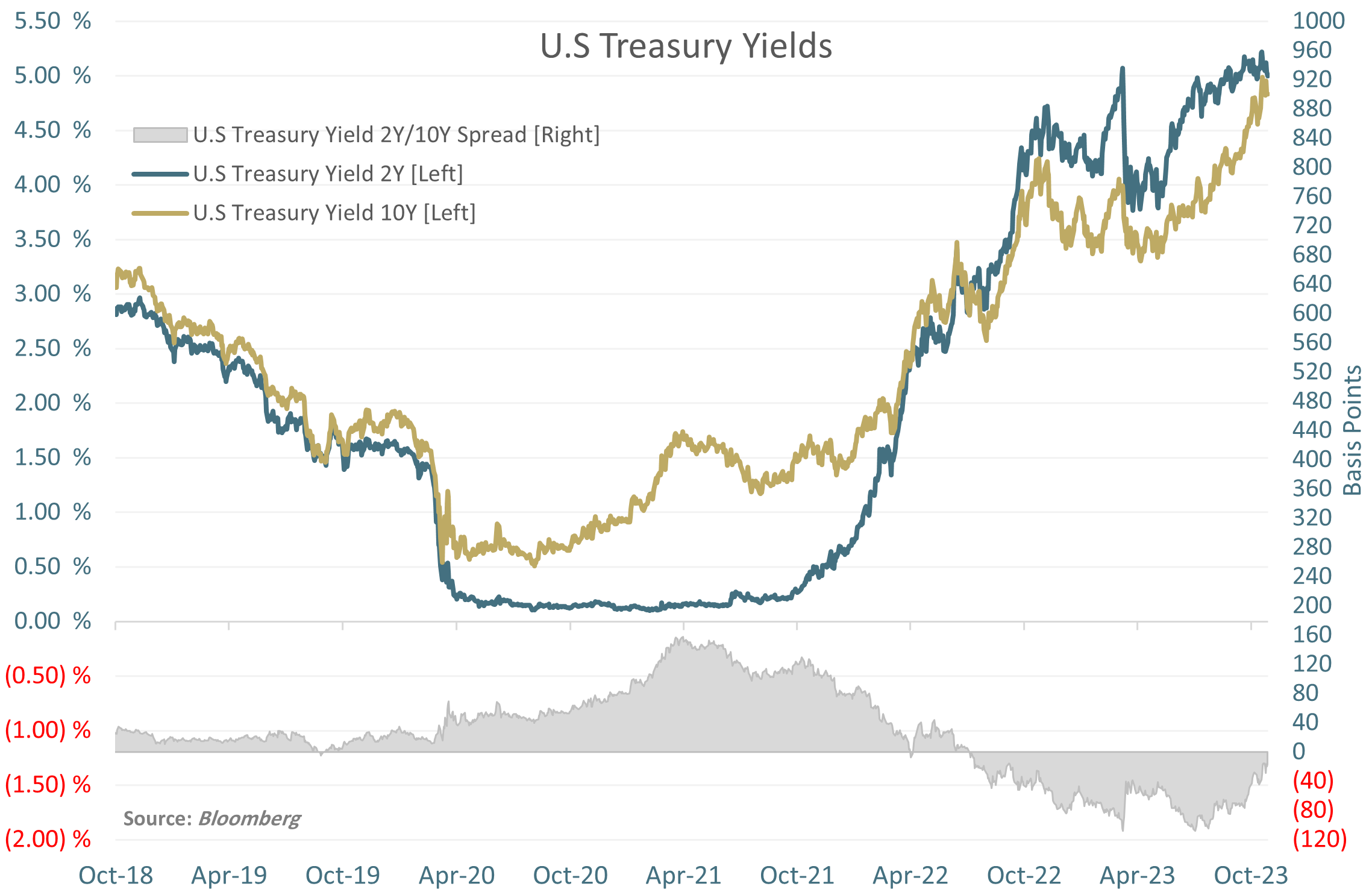

Bonds markets have also been impacted by the rise in interest rates as part of the Fed’s tightening of monetary policy. U.S Government yields have been rising steeply since July. The yield on the 10Y bond, which remained below 4.0% for a major part of 2023, crossed 4.98% for the first time since 2007. The yield on the 2Y U.S treasury bond reached its highest level of above 5.22% since 2006. The closely monitored U.S Treasury Yield 2Y/10Y spread registered its deepest inversion in July since the year 1981.

This indicates that the bond markets are also grasping what the central bankers have been indicating – higher interest rates will be here for long. The U.S economy has displayed resilience, even in the face of the steepest increase in interest rates. This signals to the bond market that the Fed would be enabled to maintain its position of keeping rates high to slow the economy for as long as necessary to combat inflation.

Bond yields and prices are inversely related. Thus, falling prices also drive-up yields. The Fed is trimming its purchases of U.S treasuries as part of the monetary policy tightening. Over USD 650 billion in treasury bonds have been taken off the Fed’s balance sheet in the past year. In addition, some foreign buyers of these treasury securities are also holding off from new purchases. Data released from China indicated a massive reduction in their U.S treasury holdings in the past year.

The Fed’s aggressive rate hikes, along with the supply-demand dynamics of the bond market, may ensure that yields stay elevated for some time, with some economists conjecturing that markets are in a period different from that of the expansionary monetary policy that followed the 2008 financial crisis and the 2020 pandemic.

Views on the future of interest rates

Bankers, investors, and market participants are divided in their opinions about where rates would go from here. Here are some of the positions taken by leaders of major financial institutions in the recent months:

- Jamie Dimon, the CEO of JPMorgan Chase, one of the largest multinational financial institutions, recently warned that the Fed may continue to hike rates by another 150 basis points to 7.0%. He mentioned the possibility of the war on inflation becoming more aggressive before it begins to get better and cautioned clients to be prepared for the worst-case scenario of the Fed Funds rate going up to 7.0%, alongside stagflation in the economy.

- Catherine Mann, a member of the Monetary Policy Committee of the UK’s Bank of England (BoE), has predicted permanent higher rates as she warned against relaxing the fight against inflation. She stated that it might be too early for the BoE to conclude its rate hikes, and that it would be preferable for the Central Bank to err on the side of caution by raising rates further, than to put a pause on the hikes prematurely.

- On the other hand, State Street, a global financial services firm, predicts that the Fed will cut rates by 100 to 200 basis points in the coming year. They argue that the Fed’s policy is restrictive enough already for the Central Bank to conclude with their hiking cycle. State Street’s prediction is opposite to the general market perception of “higher-for-longer” interest rates and comes on the back of their view that both the economic growth and inflation in the U.S has slowed sufficiently enough for the Fed policymakers to begin to pivot.

Policymakers review incoming economic data to calibrate their strategy and deliberate on the level of interest rates, which then has an impact on the economy, and on private sector participants. The Fed has embarked on their hiking cycle since March 2022, and firms have felt the adverse effects of this policy. Borrowing costs have increased dramatically since the start of last year. Rising rates have created challenges for businesses, causing distortions in the budgets and financial models that firms use and, thus, affecting their profit margins.

Times such as these offer higher economic stress and uncertainty and make necessary that firms prepare for them in advance. Firms that have a robust risk management framework will survive and thrive more successfully. With different opinions on the future of interest rates, firms that rely on sound risk management practices would be better equipped to navigate through these rough waters with certainty, direction, and awareness.