Hedging the Interest Rate Hiking Cycle

Where is inflation going?

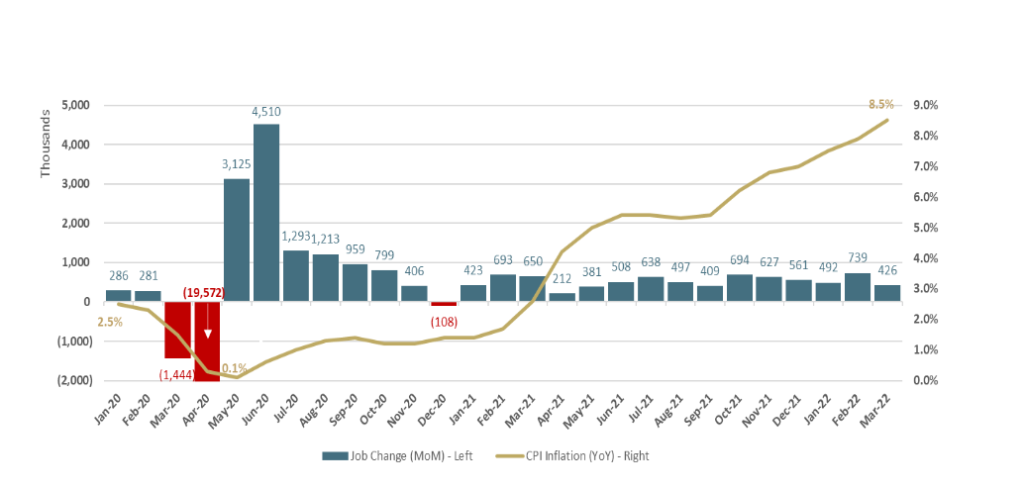

US inflation hit 8.5% in March and is now at a 40-year high. COVID-19–related supply chain issues combined with the Russia–Ukraine war have driven energy prices up a staggering 32% in the latest report. And food prices are following, up 8.8% — the largest jump since 1981. Consumers everywhere are feeling the squeeze, and many analysts are predicting a US recession.

With good reason, the US Federal Reserve is worried.

To curb inflation, the Fed started a hiking cycle at the FOMC meeting last March, raising the federal funds rate 25 basis points (bps). And it has just delivered what the market expected at the latest meeting on 5 May: a 50 bps rate hike. That is more aggressive than the first hike and shows just how alarmed the central bank is about the evolving inflation outlook.

But what comes next? The market is speculating wildly. Questions abound about the intensity of further rate hikes and whether the economy can withstand a half-dozen increases this year without sliding into recession. On the other side of the coin, fears of runaway inflation emphasize the danger of being caught behind the curve. For inflation hawks, catching up via aggressive rate hikes is an absolute necessity.

The Fed’s decisions will significantly affect the outlook for companies and investors alike. So, how can we hedge this uncertainty?

Amid rampant inflation and rising interest rates, financial risk management is critical. We must protect ourselves from interest rate volatility, from anticipated and unanticipated hikes. But how? And given how rapidly short-term rates have spiked, is it too late to hedge our floating debt? How can we prioritize financial risk-management objectives?

Don’t Obsess over Market Developments

Interpreting the Fed’s tone around potential rate hikes shouldn’t be the main focus. Instead, we need to look closer to home — at our company’s risk profile. The more leverage on the balance sheet, the harder rate hikes and shocks will be to absorb. Yet proper risk management provides both proactive and reactive measures to hedge such market risks.

Since January 2012, the Fed has released interest rate expectations every quarter. The so-called Dot Plot shows the Fed’s expectations of the key short-term interest rate that it controls for the next three years and the long term. The dots show each Fed member’s anonymous vote on the expected rate movement.

While these only guide the Fed’s actions, some corporations mistakenly rely on them to inform their risk management and hedging decisions. Yet waves of crises and unexpected events frequently batter the plots and often prove them wrong: In March 2021, for example, most Fed members expected zero rate hikes in 2022 and 2023!

Only a year later, the March 2022 Dot Plot showed a massive shift in Fed expectations: from March 2021 forecasts of zero rate hikes in 2022 to forecasts in March 2022 of six hikes in 2022. And since then, the Fed’s tone has only grown more hawkish. We shouldn’t fixate on what the Fed says it will do; it very likely won’t do it.

Understand You Debt Exposure and Sensitivity to Interest Rate Movements

All companies should carefully plan their current and future debt requirements. Managing financial risks becomes more straightforward with a clear debt plan.

But whether it’s to fund an acquisition, refinance a loan, or support ambitious capital expenditure, the hedging strategy requires the utmost attention. After all, if the pandemic has taught us anything, it is that the future is radically uncertain.

As part of the hedging assessment and feasibility process, a firm must build reasonable expectations for the duration, amortization plan, and floating interest rate index and evaluate the tools available to implement its intended hedging strategy.

With Hedging Products, Go Old School!

Choosing the hedging instrument requires high scrutiny and careful considerations to reduce and mitigate the market risk arising from the interest rate exposure. We can decrease risk by creating an offsetting position to counter volatilities exhibited in the hedged item’s fair value and cash flows. This may mean forgoing some gains to mitigate that risk.

It is always advisable to stick to the vanilla instruments to hedge our debt. These include interest rate swaps and interest rate caps. Future debt can also be hedged with fair assurance of the anticipated debt. A forward-starting interest rate swap (simply booking a fixed swap rate in the future), an interest rate cap, and other simple hedging instruments can accomplish this.

The more complex a hedging instrument becomes, the more challenges it introduces on pricing transparency, valuation considerations, hedge accounting validity, and overall effectiveness. So, we should keep it as simple as we can.

It Is Impossible to Time the Market

The preceding statement applies to risk management. Firms must avoid trying to solve for the best hedge entry point. Instead, we should act based on pre-set objectives, risk tolerance, hedging parameters, and a governance framework.

Consider the current interest rate environment. In companies that are sensitive to higher interest rates, management might think that rate hikes are already reflected, or priced in, in the current market levels. Management may not believe that the interest rate curve will be more expensive in the future and may think purchasing a hedge is unnecessary.

However, there are hedging products that provide more flexibility during lower rate environments while also offering protection on the upside. A hedging policy governs all these factors in more detail and provides management with the necessary guidance to avoid relying on subjective and individual decisions.

Why Is Hedge Accounting Important?

When using hedging instruments to protect the company from unfavorable market movements, the accounting implications are critical.

Appropriately applying hedge accounting standards reduces the volatility of financial statements in the firm’s bookkeeping. Hedge accounting helps reduce the profit and loss (P&L) statement volatility created by repeated adjustment to a hedging instrument’s fair value (mark-to-market — MTM). The critical terms of the hedged item (the debt) and its associated hedging instrument (financial derivatives) should match.

Hedge accounting follows a well-defined accounting standard that must be applied for a successful designation. Otherwise, the hedging instrument’s fair value would directly impact the P&L statement. Some institutions prioritize accounting implications over the economic benefits and vice versa. The hedging policy must address what comes first in terms of prioritization.

Takeaways

In uncertain times like these, there are countless perspectives about the direction of future market movements. The inflation hawks are becoming more hawkish, while the doves remain firm in their bearish stance.

Corporations and investors alike reap the benefits of a proper financial risk management plan during good and bad times. Such preparation mitigates the effects of our personal cognitive biases and ensures sustainability and endurance during the most challenging market conditions.

While we cannot and should not hedge everything, sound planning cultivates a culture of risk management across the entire corporation. Ultimately, however, the board of directors and the executive team are responsible for setting the tone.

Again, Nick Murray offers some wisdom: