The Role of Quantitative Easing (QE)

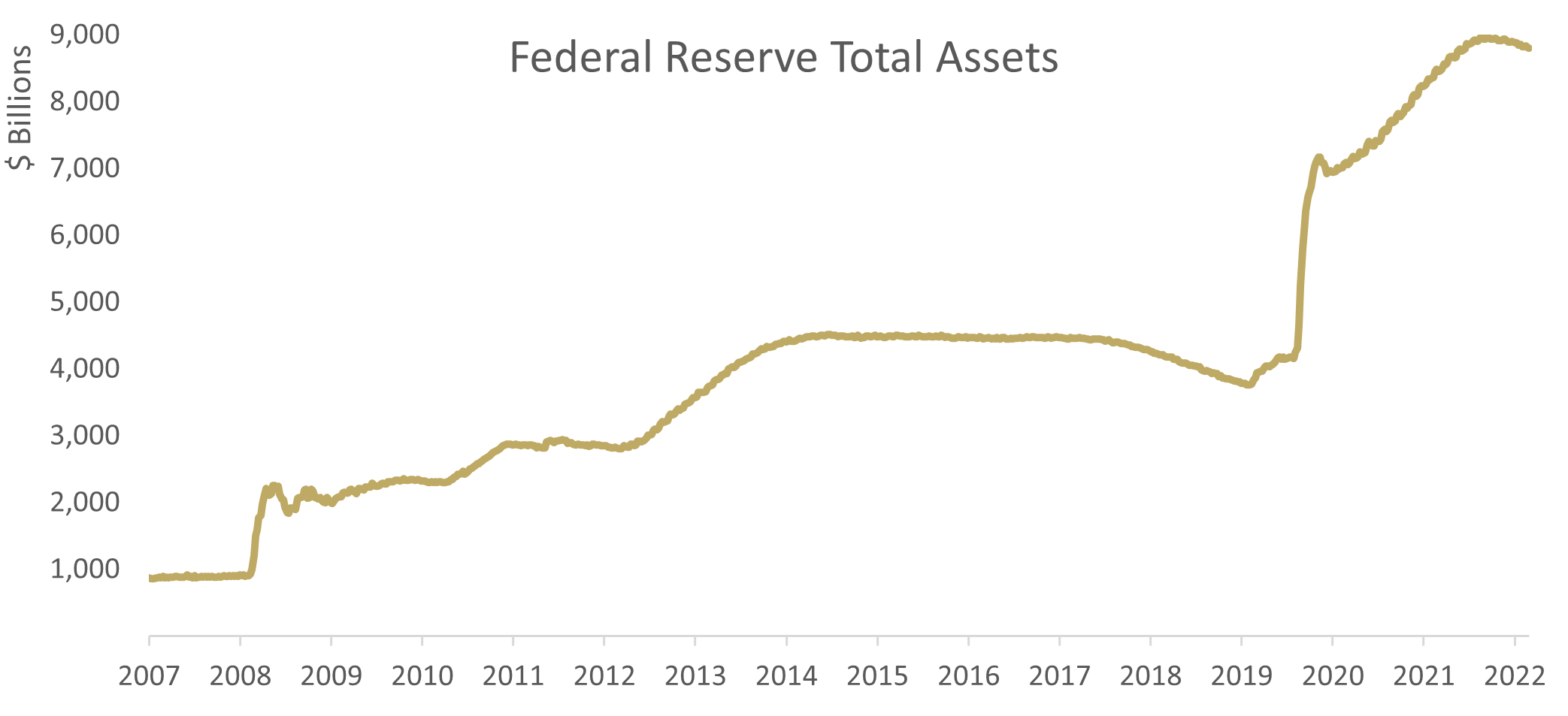

The size of United States Federal Reserve’s balance sheet is now 10x the size it was by the end of 2007, mainly amid the Quantitative Easing (QE) adopted by the Fed. In May 2022, Federal Open Market Committee (FOMC) announced its balance sheet ‘Normalization’ plan, as it aims to bring down its total assets to “the level it judges to be consistent with ample reserves”. In this bulletin, we will explore the applications of quantitative easing policies, compare them with conventional monetary policy tools, and try to understand their consequences on real economy and financial economy.

Conventional and Unconventional Monetary Policies

For centuries, altering coinage and paper printing were the only tools to control the money supply. Over time, monetary policy tools have flourished and evolved. Monetary policy toolkit first began its expansion by including what we now call ‘conventional’ monetary policies, such as: changing short term interest rates and reserve requirements. Lately, central banks utilized ‘unconventional’ monetary policies like Negative Interest Rate Policy (NIRP), forward guidance, and Asset Purchases Programs (APPs).

Quantitative Easing (QE) policies include central-bank purchases of assets (like government bonds and other securities). Purchases of long-term assets was first introduced by the Bank of Japan in 2001 and adopted by other major developed countries central banks in response to the global financial crisis in 2008-2009. The purpose of QE policies is to increase money supply levels to provide financial ecosystems with the required level of liquidity. Therefore, QE policies are considered ‘expansionary’ monetary policies. Thus, they are expected to achieve results similar to reducing short term interest rates, the primary tool that central banks use to control money supply.

The most recent application of QE was the Bank of England’s (BoE) intervention in bond markets during September 2022 to avert credit crunch and economic fallout. BoE QE helped GBPUSD rise from 1.06 to 1.12 in less than a week. Noteworthy, QE policies are often used in situations where changing the short-term interest rate is no longer effective or when the central banks see the need to give the economy an extra boost.

Looking at central banks’ response to Covid-19 pandemic, we noticed that APPs were extensively utilized by central banks of Japan, the United Kingdom, the United States, and the Euro area. The Fed has been buying $120 billion worth of securities every month and has added about $4.8 trillion in total assets between February 2020 and March 2022. Later in May 2022, FOMC announced that it intends to slow and then stop the decline in the size of its balance sheet when reserve balances are somewhat above the level it judges to be consistent with ample reserves.

The graph below shows the size of Federal Reserve Assets over time:

Source: www.federalreserve.gov

The question remains, what would be “ample” for the Fed’s balance sheet? QE advocates suggest that the Fed will continue to need a massive balance sheet that could be influential enough as a policy tool. On the other hand, many economists including central bankers, are challenged in finding how buying long-dated treasuries can help in keeping unemployment low. Thus, argue that massive APPs can cause a disconnect between financial markets and the real economy and would, therefore, need to remain low.

Benefits and Side Effects of APPs?

Benefits: It is quite difficult to isolate the effects of conventional policies, like lowering short-term interest rate, and unconventional policies like APPs. However, there is a broad consensus that asset purchases have been very effective in enhancing market liquidity and contributing massively to the post-pandemic recovery being one the fastest post-crises recoveries of all time. A World Bank study in 2021 indicated that the APPs used by developing countries’ central banks have affected domestic bond yields more strongly than conventional policy rate cuts and developed economies’ QE programs. Former Fed Chair Ben Bernanke estimated that, in the previous quantitative easing episode (2014), every $500 billion spent in QE lowered the 10-year treasury yields by 20 basis points. If the results still apply, the Fed’s 2020 asset purchases of $4.8 trillion would reduce about 191 basis points in the 10-year treasury yields. Lower long-term interest rates could be vital in reducing corporates cost of funds and contributing positively to boosting GDP growth.

Side effects: As many of you predicted, by providing abnormal liquidity levels, major central banks have contributed to magnifying inflation risk, a risk that almost all of the developed countries’ central banks are now strongly committed to resolve. Reacting to extraordinary inflation levels, the Fed hiked interest rates five-times this year to upwardly push the fed fund rate to a range of 3.00% – 3.25%.

Key Challenges to Policy Makers

A report by the United Nations’ Department of Economic and Social Affairs warned policy makers about the substantial risks of withdrawing stimulus too fast or by waiting too long with tightening. With rising debt-to-GDP ratios among many countries, the debt-servicing cost grew more sensitive to interest rate changes. The US’s debt-to-GDP ratio stood at a relatively high level of 121% by the end of 2Q’22. Moreover, at the time of writing this report, the yield on 2-year treasury notes was well above 4%. So, how much of a debt burden can the US take? the United Nations’ report showed that if rates were to exceed 4%, the US debt servicing cost margin of revenues could increase from the 2020 level of 10% to over 22% by 2030.

In conclusion, APPs proved useful in providing economies with a stress-relief during times of crisis and market turbulence, but they possess key risks to inflation, disconnect between real economy and the financial economy, as well as risks of losing sustainability in sovereign debt amid high debt servicing costs.