Risk Management lessons learnt from 2022

Just a few weeks before the end of the year 2022, the U.S Federal Open Market Committee (FOMC) announced a further 50 basis point hike to the Federal Funds rate. This latest rate hike was the seventh in the year 2022 and followed four consecutive 75 basis points hikes by the Federal Reserve. The upper bound for the said rate, which started the year at 0.25%, had reached 4.50% by the end as a result of these subsequent hikes. The current level marked its highest since 2007. The U.S Fed was not alone; the UK’s Bank of England (BoE) and the Eurozone’s European Central Bank (ECB) implemented numerous hikes on their respective rates throughout the year.

The U.S Fed, in their last statement for the year, indicated that while the spending and production figures improved, and the unemployment rate remained low, inflation remained elevated and way above their target of 2.0%. The Feds’ preferred measure for inflation in the United States, the personal consumption expenditures price index (PCE) had cooled to 4.7% (Y-o-Y change) for November 2022, its weakest level in four months. While this warranted only a 50-bps hike in the last FOMC meeting, which had earlier been raising rates more aggressively, it reaffirmed the committee’s stated stance of bringing inflation down to its target range. This means that they would be prepared to raise rates in higher increments and let rates remain elevated for as long as it takes. Members within the Federal Reserve have predicted that the rate could reach up to 4.9% in 2023, while other economists and financial institutions forecast the interest rate to reach 5.25% by mid-2023. It goes without saying that this higher cost of funding exerts pressure on corporate institutions, especially in the west, where the funding cost has remained low for extended periods.

The Saudi Arabian Central Bank, or SAMA, in order to maintain monetary stability, also followed suit and raised the rates accordingly. The rate of Reverse Repurchase Agreement (Reverse Repo Rate) started the year at 0.50% and had reached 4.50% by December 2022 following the successive rate increases. By October 2022, SAIBOR 3M rate had reached a level that marked its highest in 20 years. Similarly, the central banks of most of the GCC countries had raised their rates considerably in tandem with the Fed. The rising interest rates, amid the volatile economic environment that necessitated them, remained an area of grave concern for firms locally and globally for a major part of the year.

While the world was recovering from the shocks the COVID pandemic created in 2020, it faced another one in the form of the Russia-Ukraine conflict. The conflict started at the beginning of the year and caused a momentous disruption in the commodity supply chains. This had an obvious and adverse ramifications on commodity prices which then skyrocketed. Russia is a leading exporter of crude oil and other fuels, and both Russia and Ukraine are major producers of Wheat and other agricultural commodities. The start of the conflict created chaos in the markets and raised concerns around Russia’s ability to meet the demand for crude oil. Within a few weeks following the conflict’s start, prices of Agricultural commodities like Corn and Wheat had reached decade-highs. Oil prices climbed above USD 100 per barrel for the first time since 2014.

These soaring prices have led to decades-high inflation in the western economies, prompting the Fed to pursue a series of rate hikes, even in the face of an economic slowdown. No one has been able to escape the impact of the events that took place in 2022. As we enter the new year, it is important to remember the lessons learnt, highlight the risks that lie ahead and assess the capability to handle them.

The Interest Rate Environment

Rising funding costs have been the theme for the year 2022. The Federal Reserve funds rate is currently at its highest since the last financial crisis in 2008. Owing to the fact that one expects the interest rates to revert to their long-term mean, they are expected to remain elevated through most of 2023.

The yield curve for interest rates represents the cost of funding for interest rate securities at different tenors. The normal yield curve refers to one that has an upward slope, i.e., long-term rates are higher than short-term rates. Aside from the normal curve, the yield curve can take the form of a flat curve (where yields across tenors would be the same across maturities) and an inverted curve (one with a downward slope, i.e., long-term rates are lower than short term rates). While the year began with a normal yield curve for most underlyings, since March most yield curves have been inverted. In this environment, it becomes critical to be more aware of what an inverted yield curve means and how best to navigate these in alignment with the firm’s objectives and risk management framework.

Source: Bloomberg

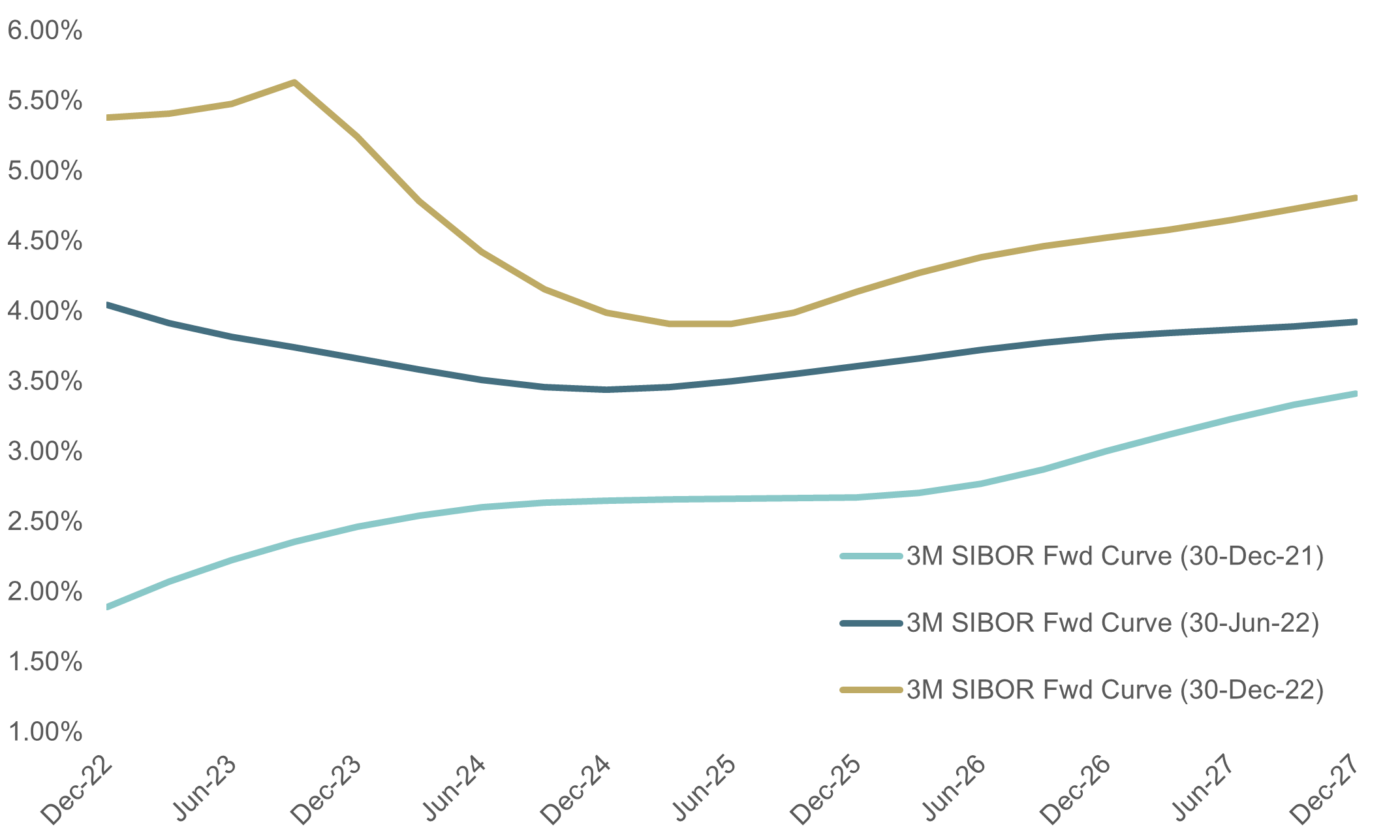

The chart above plots the forward curves for the SAIBOR 3M rate for three dates: current (30-Dec-2022), 6 months in the past (30-Jun-2022), and 1 Year in the past (30-Dec-2021). Based on the current curve, it can be observed that the inversion has deepened when compared to the curve six months ago. The market expects rate increases and higher volatility in the near term. The curve falls steeply in the medium-term and then evolves to represent a normal curve in the long-term.

Inverted yield curves are mostly a rare occurrence and are usually associated with an economic slowdown. The signs of an economic slowdown have not been missed. Economists globally are predicting a negative outlook for the year 2023. The International Monetary Fund (IMF), in their “World Economic Outlook” report in July 2022, lowered their estimate for growth in the world economy in 2022 to 3.2%. They later reaffirmed this figure in their October release. Economists in the U.S place a very high probability of a recession there in 2023. Similarly, the Bank of England warned of the most prolonged recession the UK has seen in 100 years. The Eurozone, which gets most of its gas from Russia, is already facing slowdowns that are expected to worsen.

Lessons Learnt

The COVID pandemic in 2020 and the Russia-Ukraine conflict in 2022 outline the threats to the everyday functioning of corporates globally. Each crisis causes a ripple effect and leads the economies into deeper uncertainty. The lessons of the past few years have been clear; the risks are ever persistent and necessitate deliberate action on the part of each firm to recognize, measure, and mitigate these risks. Additionally, these risks are not limited to an individual firm, industry, or market but can arise from local and global factors as well, including from the macroeconomic environment and monetary policies.

Some of the key takeaways from the year 2022 are listed below:

Establish a Risk Management Framework – The past few years have seen the occurrence of multiple Black Swan events. In these times of heightened uncertainty, establishing a Risk Management framework is essential to the smooth functioning of any business. The framework should be adapted to the firm’s operational nature and business objectives. It should identify the firm’s sources and tolerance of risk and be clear enough to lead the firm through periods of volatility with a clear heading. It needs to cover the firm’s exposure to market risk from movements in interest rates and foreign exchange pairs (and commodities if the operations of the firm necessitate it).

Follow the Risk Management Framework – The established framework should list out the firm’s KPIs and the action plan to follow if the risks exceed the tolerance limit. Additionally, it should be comprehensive enough to follow while incorporating best market practices. As an example, throughout 2022 we observed the use of Interest Rate Cheapeners (such as Range Accrual Swaps) by firms looking to reduce the cost of hedging. In a number of cases, the firms employed them without recognizing the risks associated with such instruments. These instruments leave the holder vulnerable to significant losses in the event that the interest rate exceeds a certain range, such as the scenario we are currently in. The Risk Management framework should be detailed and identify the type of instruments that can or cannot be used and the risks associated with the use of these instruments.

Plan for the future – While the future can be uncertain, it pays to have a plan and to ascertain future scenarios to the extent possible. This includes facilitating the development of cash inflow and outflow projections. This also includes the recognition of risks that may arise in the course of the business activities. Additionally, the firm should keep an eye on the macro and micro economic conditions and the risks changing conditions pose to the firm’s operations. This also includes being aware of and prepared for any expected changes in the regulatory framework that would have an impact on the firm. An example of this is the planned discontinuation of LIBOR as the interest rate benchmark to alternative rates such as SOFR by July 2023.

Build Supply-Chain Resilience – This is perhaps the most important lesson that 2022 has to offer. A significant portion of the year was dominated by the supply-chain disruptions caused earlier by the COVID pandemic and currently by the Russia-Ukraine conflict, and policymakers worldwide scrambling to combat the impact of these disruptions on businesses and individuals alike. The world has so far gained from globalization; however, this brings about a whole other set of risks. Firms with operations that utilize commodities and raw materials need to build robust processes to scope out and mitigate threats to the supply-chain in an interconnected world.